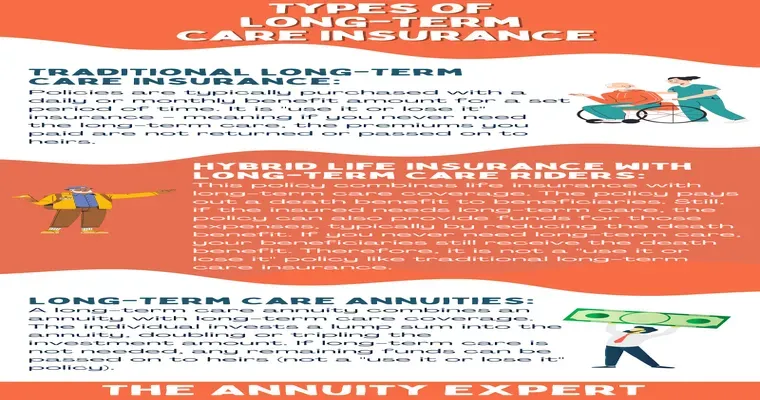

Facing a "Medicaid denial" can be an overwhelming experience, especially when it's related to a "term life insurance policy" that you cannot locate. Many individuals apply for Medicaid to receive the healthcare coverage they need, but if there are assets or policies that have not been properly documented, it can lead to complications in the application process. This article will explore the reasons behind Medicaid denials linked to untraceable insurance policies and provide guidance on how to address this issue.

When applying for Medicaid, applicants must disclose all assets, including any "life insurance policies". However, if a term life insurance policy is lost or cannot be found, it can complicate your eligibility. Medicaid has strict guidelines regarding asset limits, and a policy that is not accounted for may suggest that you possess more resources than you actually do. This could lead to a denial of your application, leaving you without the coverage you desperately need.

Understanding the specifics of a "term life insurance policy" is crucial. Unlike whole life insurance, which builds cash value, term life insurance is designed to provide coverage for a specific period and does not accumulate savings. This means that if you are not able to find the policy documentation, it may appear as if you have an unaccounted asset, affecting your financial standing in the eyes of Medicaid.

So, what steps can you take if you find yourself in this situation?

1. "Conduct a Thorough Search": Start by looking through past financial documents, emails, and any other records that might provide clues about the term life insurance policy. It may be helpful to contact previous employers or insurance agents who may have information regarding your policy.

2. "Contact the Insurance Company": If you remember the name of the insurance provider, reach out to them directly. They may be able to assist you in locating your policy using your personal information.

3. "Check State Resources": Many states have resources available to help individuals locate unclaimed life insurance policies. You can check with your state’s department of insurance for guidance.

4. "Seek Professional Help": If you continue to struggle with tracking down your term life insurance policy, consider consulting a Medicaid planner or an attorney who specializes in elder law. They can help navigate the complexities of Medicaid applications and asset tracking.

5. "Reapply for Medicaid": Once you have located your policy or received confirmation that it does not exist, you can reapply for Medicaid. Make sure to include all relevant documentation to avoid further complications.

In conclusion, being denied Medicaid due to a "term life insurance policy" that you cannot track down can be frustrating. However, by taking proactive steps to locate the policy and understand its implications, you can improve your chances of successfully obtaining the coverage you need. Remember that thorough documentation and clear communication with Medicaid can make a significant difference in your application process.