Navigating the world of "life insurance" can be challenging, especially for individuals with pre-existing conditions like "Alzheimer's disease". Many families wonder if a person diagnosed with Alzheimer's can secure a policy, what options are available, and how their condition may affect premiums and coverage. This article aims to clarify these concerns and provide insights into obtaining life insurance for someone with Alzheimer's.

Understanding how Alzheimer's impacts life insurance eligibility is crucial. Most traditional "life insurance companies" assess applicants based on their health history, age, and lifestyle factors. Since Alzheimer's is a progressive neurological condition, it can complicate the application process. Insurers may view the diagnosis as a higher risk, potentially leading to higher premiums or even denial of coverage.

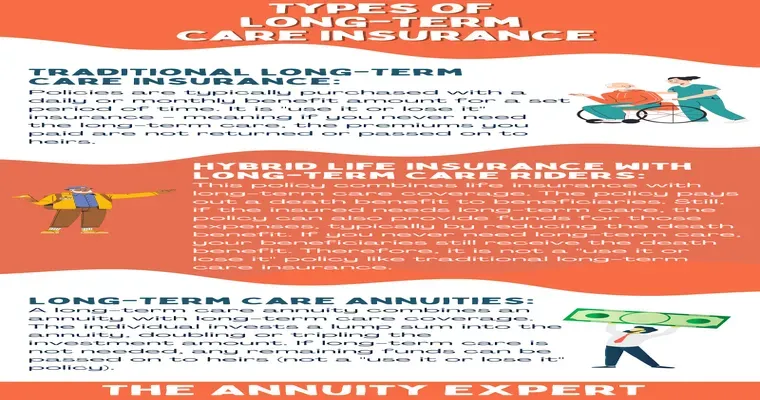

However, there are still options available for individuals with Alzheimer's. Some companies specialize in offering "guaranteed issue" life insurance, which does not require a medical exam or health questions. This type of policy is often more expensive, but it can provide peace of mind for those who want to ensure their loved ones are financially secure after their passing.

Another alternative is "simplified issue life insurance", which involves fewer health questions compared to traditional policies. While it may still require some medical information, it generally has a faster approval process. Individuals with early-stage Alzheimer's may find this option appealing as it allows for coverage without extensive medical evaluations.

It's important to note that the amount of coverage available may be limited for those with Alzheimer's. Insurers typically impose caps on the maximum benefit for high-risk applicants, which means that the policyholder may not be able to secure a large death benefit.

When seeking life insurance for someone with Alzheimer's, it's beneficial to work with an experienced insurance agent who understands the nuances of policies available for individuals with chronic illnesses. They can help navigate the complexities and find the best options tailored to the individual's needs and circumstances.

In conclusion, while obtaining life insurance for a person with Alzheimer's can be more difficult than for those in good health, it is not impossible. With various options such as "guaranteed issue" and "simplified issue" policies, individuals can still find ways to ensure their loved ones are taken care of financially. It is essential to conduct thorough research and consult with professionals to make informed decisions regarding life insurance coverage.