When a loved one, particularly a parent, is diagnosed with "dementia", it raises significant concerns about their "financial planning" and the management of their "assets". In such cases, many families find themselves questioning the validity of existing estate plans, such as a "Transfer on Death (TOD)" designation, and whether a sibling can create a "living trust" on behalf of a parent who may no longer be capable of making informed decisions.

Understanding the implications of dementia on estate planning is crucial. Dementia can affect a person’s cognitive abilities, which may impact their understanding of legal documents and their ability to make sound decisions. If your mother has been diagnosed with dementia, it is essential to assess her mental capacity to ensure any legal documents she signs, including a living trust, are valid.

Assessing Mental Capacity

Before a sibling can create a "living trust", it is vital to determine whether your mother still possesses the mental capacity to understand the implications of such a decision. Capacity is often assessed through medical evaluations, which can provide documentation regarding her cognitive state. If she is deemed capable, she can willingly participate in the creation of a living trust that reflects her current wishes.

The Role of Durable Power of Attorney

If your mother is not mentally capable of creating a living trust, a "durable power of attorney" may come into play. If she previously designated a sibling or another trusted individual as her agent, that person may have the authority to manage her financial affairs, including establishing a living trust. This authority typically extends to making decisions regarding her assets and managing her estate according to her best interests.

Altering the Transfer on Death Designation

In situations where a "TOD" was established prior to your mother’s dementia diagnosis, it may be necessary to revisit that designation. A living trust can provide a more comprehensive estate planning solution, especially if there are changes in family circumstances or your mother’s wishes. However, altering or revoking a TOD will depend on your mother’s capacity to understand the changes being made. If she lacks this capacity, the existing TOD may remain in place unless a legal guardian is appointed to manage her affairs.

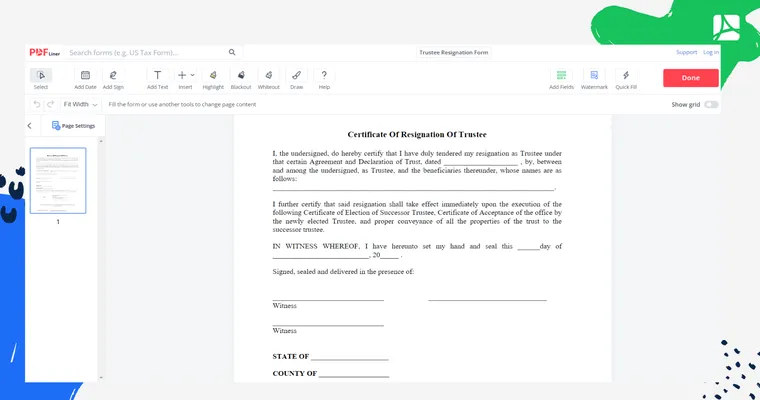

Seeking Legal Guidance

Navigating the complexities of estate planning in the context of dementia can be overwhelming. Consulting with an "estate planning attorney" is highly recommended. An attorney can help clarify the legal implications of creating a living trust, altering a TOD, and ensuring that the steps taken comply with state laws. They can also assist in determining your mother’s capacity and guide you through the processes involved in establishing a living trust or managing her existing estate plans.

Conclusion

In conclusion, whether a sibling can create a living trust when your mother has been diagnosed with dementia depends on her mental capacity and the existing legal documents in place. If she is still capable, she can create or alter her estate plans to reflect her current wishes. If she is not, exploring options such as a durable power of attorney and seeking legal advice are critical steps. Ultimately, ensuring that your mother’s estate is managed according to her best interests and desires is the primary goal in these challenging circumstances.