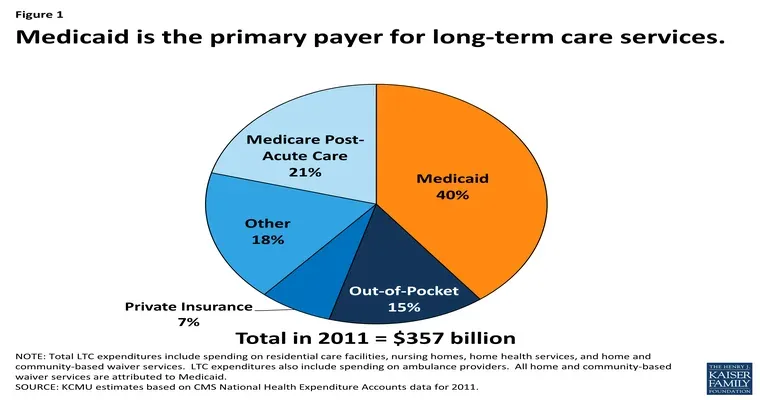

When both parents require nursing care and are recipients of "Medicaid", understanding how their "home" can be maintained financially becomes crucial. Particularly, if the house is in a "trust", there are specific financial strategies and legal considerations that can help ensure the property remains secure without jeopardizing Medicaid eligibility.

Firstly, it is essential to recognize that Medicaid has strict income and asset limits. When both parents enter nursing care, their eligibility for Medicaid can depend on how their assets, including the family home, are managed. In many cases, the "home" is considered an exempt asset, meaning that Medicaid will not count it against the asset limit for eligibility. However, certain conditions apply, especially when the house is held in a "trust".

A "trust" can provide significant advantages in this situation. If the house is placed in a "revocable living trust", the parents can retain control over the property while still qualifying for Medicaid. However, if the trust is irrevocable, it may prevent the parents from accessing the equity in the home, but it can also protect the property from being considered an asset when applying for Medicaid.

To maintain the house financially while both parents are in nursing care, several strategies can be implemented:

1. "Trust Management": Ensure that the trust is properly managed by a trustee who can handle the financial obligations associated with the home, such as property taxes, insurance, and maintenance costs. The trustee can use funds from the trust to cover these expenses without affecting Medicaid eligibility.

2. "Rental Income": If the house is not being used, consider renting it out. Rental income can help cover the costs associated with the property. However, it is essential to consult with a Medicaid planner to understand how rental income might affect Medicaid eligibility.

3. "Family Assistance": Family members can also step in to help maintain the house financially. This could include covering expenses or assisting with management tasks, which can help keep the home in good condition without using the parents' Medicaid-covered income.

4. "Home Equity Conversion": If the house is not in a trust, parents may consider a "reverse mortgage" to access their home equity. However, this option should be carefully evaluated, as it can affect Medicaid eligibility and may require consultation with a financial advisor.

5. "Consulting Professionals": Engaging with professionals such as elder law attorneys, financial planners, or Medicaid specialists can provide valuable insight into maintaining the house while navigating the complexities of Medicaid. They can offer tailored advice based on the specific circumstances of the parents’ situation and the structure of the trust.

In conclusion, if both parents need to go into nursing care and are on Medicaid, maintaining the house financially while it is in a trust requires careful planning and management. By utilizing the advantages of the trust, considering rental options, and seeking professional advice, families can ensure that the home remains protected and well-maintained, even as they navigate the challenges of long-term care.