When creating a "Will" for a loved one, especially when you have a "disabled daughter" who requires special attention for her "financial" and "medical" needs, finding a suitable "Trustee" can be challenging, particularly if you have no relatives available to take on this responsibility. However, it is crucial to ensure that your daughter is cared for and that her affairs are managed responsibly. Here are several options to consider when appointing a trustee in your will.

Professional Trustees

One of the most effective options for managing your daughter's needs is to hire a "professional trustee". These are experienced individuals or organizations, such as banks or trust companies, that specialize in managing trusts and estates. They have the expertise to handle the complexities associated with "financial management" and can ensure that your daughter's needs are prioritized. Professional trustees can also provide impartiality, which is particularly beneficial in sensitive family situations.

Friends or Trusted Individuals

If you have close friends or acquaintances who understand your daughter's needs and can commit to managing her affairs, you might consider appointing them as a trustee. Ensure that they are willing to take on this responsibility and have the necessary skills or experience to navigate financial and medical decisions. It is important to have open discussions about this role to ensure that they are comfortable and capable of fulfilling the responsibilities associated with being a trustee.

Corporate Trust Services

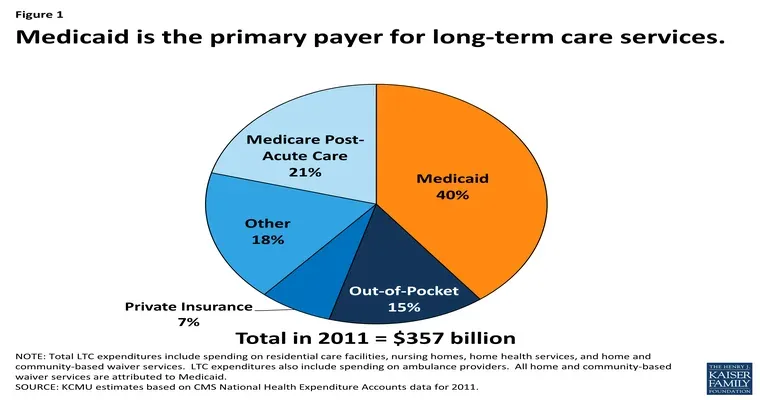

Many financial institutions offer "corporate trust services" tailored for individuals with special needs. These services can help manage your daughter's assets and ensure that her financial decisions are made in her best interest. Corporate trustees are bound by fiduciary duty, meaning they must act in your daughter's best interest and manage her resources prudently.

Special Needs Trusts

Setting up a "special needs trust" can provide financial support for your daughter without jeopardizing her eligibility for government benefits. A special needs trust can be managed by a trustee of your choosing, whether that is a professional, a friend, or a corporate trustee. This type of trust is designed specifically to meet the needs of individuals with disabilities, ensuring that funds are used for their benefit while maintaining compliance with government regulations.

Legal Assistance

Consulting with an "attorney" who specializes in estate planning and special needs can provide you with guidance on the best options available for your situation. They can help you draft a will or trust that addresses your daughter's needs, ensuring that all legal requirements are met. An attorney can also assist in identifying potential trustees and provide advice on how to choose the right individual or organization.

Consideration of Guardianship

In addition to establishing a trustee, you may also want to consider appointing a "guardian" for your daughter. A guardian is responsible for making personal and medical decisions on behalf of your daughter, while a trustee manages her financial affairs. It is essential to differentiate between these roles and ensure that the individuals you choose are trusted and capable of meeting her needs.

Conclusion

While not having relatives to act as a trustee can be daunting, there are numerous options available to ensure that your disabled daughter receives the care and management she needs. Whether through professional trustees, trusted friends, or specialized trust services, you can create a comprehensive plan that addresses her "financial" and "medical challenges". Taking the time to explore these options and consulting with professionals will provide you with peace of mind, knowing that your daughter's future is secure.