When considering "Medicaid eligibility", many individuals are often concerned about the impact of their "life insurance policies". Understanding how these policies can influence your qualification for Medicaid is crucial, especially if you or a loved one may need long-term care in the future. This article explores the relationship between life insurance and Medicaid eligibility, shedding light on what you need to know to protect your assets while ensuring access to necessary healthcare services.

Understanding Medicaid Eligibility

Medicaid is a state and federally funded program that provides health coverage to low-income individuals, including those who require long-term care. To qualify for Medicaid, applicants must meet specific income and asset requirements, which can vary by state. Life insurance can play a significant role in this evaluation, as policies may be considered assets.

How Life Insurance Policies are Classified

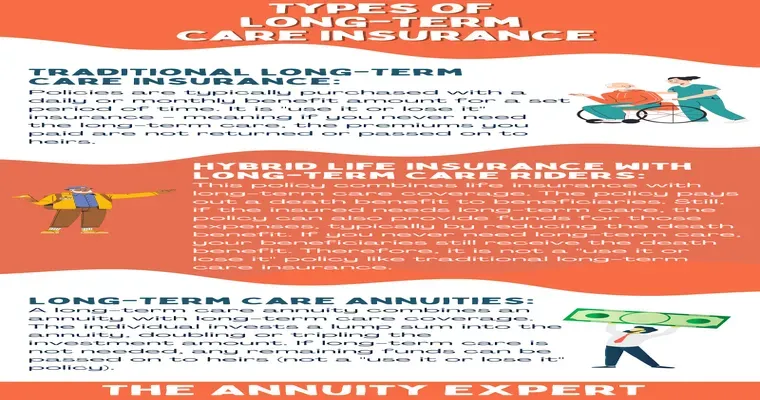

Life insurance policies are generally categorized into two types: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period and typically has no cash value, making it less likely to impact Medicaid eligibility. Permanent life insurance, on the other hand, can accumulate cash value over time, which can affect asset limits.

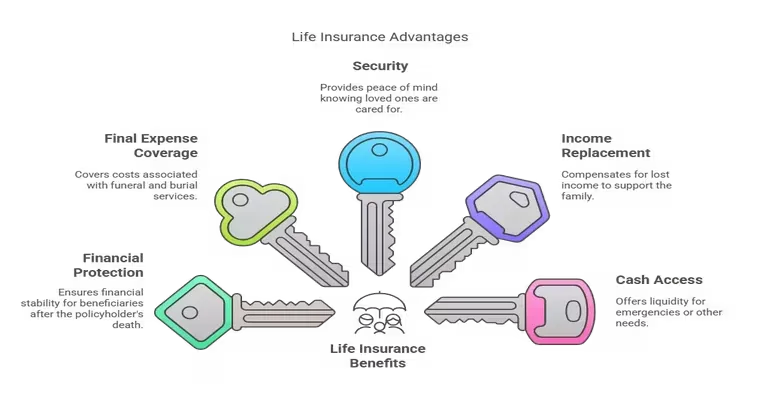

Cash Value and Medicaid

One of the primary considerations for Medicaid eligibility is the "cash value" of a permanent life insurance policy. If the cash value exceeds the allowable asset limits set by your state, it could disqualify you from receiving Medicaid benefits. For example, if you have a whole life insurance policy with a cash value of $20,000, and your state's asset limit is $15,000, you may be ineligible for Medicaid unless you take action to reduce your assets.

Strategies to Protect Your Eligibility

To maintain Medicaid eligibility while managing life insurance policies, consider the following strategies:

1. "Avoid Accumulating Cash Value:" If you are planning for potential Medicaid needs, opting for term life insurance instead of permanent life insurance can help you avoid cash value complications.

2. "Pay Off the Cash Value:" Some individuals choose to withdraw or borrow against the cash value of their permanent life insurance policies to reduce their assets. However, this must be done carefully to avoid tax implications.

3. "Transfer Ownership:" In some cases, transferring ownership of a life insurance policy to a spouse or a trusted family member may help protect the policy's cash value from being counted as an asset. Be mindful of the Medicaid look-back period, which is typically five years, as transfers made within this timeframe may be scrutinized.

4. "Consult a Medicaid Planning Expert:" Given the complexities surrounding Medicaid eligibility and life insurance, seeking advice from a Medicaid planning expert or an elder law attorney can provide tailored strategies based on your specific situation.

Conclusion

In summary, "life insurance policies" can indeed affect "Medicaid eligibility", particularly if they have a cash value that exceeds state limits. Understanding the implications of your life insurance choices is essential for anyone looking to qualify for Medicaid. By taking proactive steps and consulting with professionals, you can ensure your financial security while still accessing the healthcare benefits you may need in the future. Always remember to stay informed and plan ahead to maintain your eligibility for this vital program.