Navigating conversations about "life insurance" can be challenging, especially when it involves a loved one like your mother. If you believe that she cannot continue her "life insurance plan", it is essential to approach the topic with care and empathy. This article will provide you with practical tips to help your mother understand the situation while ensuring she feels supported and informed.

Start with Empathy

Begin the conversation by expressing your concern for her well-being. Let her know that you value her opinions and feelings about her "insurance policy". Use phrases like "I understand this is a sensitive topic" to create a comfortable atmosphere for discussion. By showing empathy, you can help ease any potential tension and encourage open communication.

Discuss Financial Realities

Bring up the "financial implications" of continuing her current life insurance plan. Discuss the premiums and whether they fit within her overall budget. If there are financial constraints, make her aware of alternative options. Highlight that sometimes, it may be better to allocate funds towards necessities or savings rather than maintaining a policy that may no longer be affordable.

Explain Policy Benefits and Limitations

Take the time to explain the specific benefits and limitations of her "life insurance policy". If the policy is not providing adequate coverage or if there are significant changes in her life circumstances, it may be necessary to reconsider her options. Use clear and simple language to ensure she understands the terms of the policy and how it aligns with her current needs.

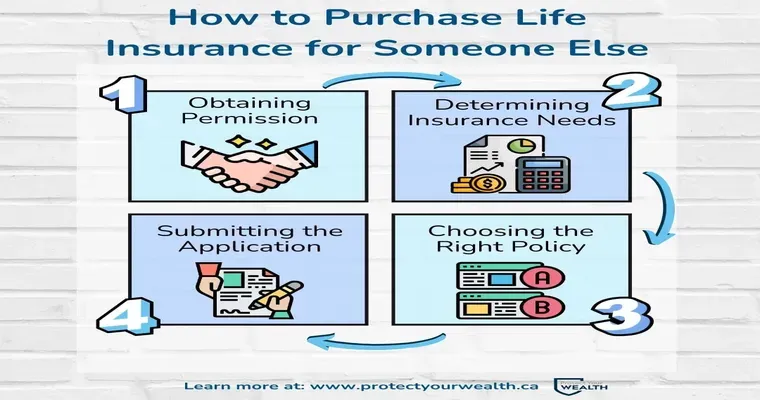

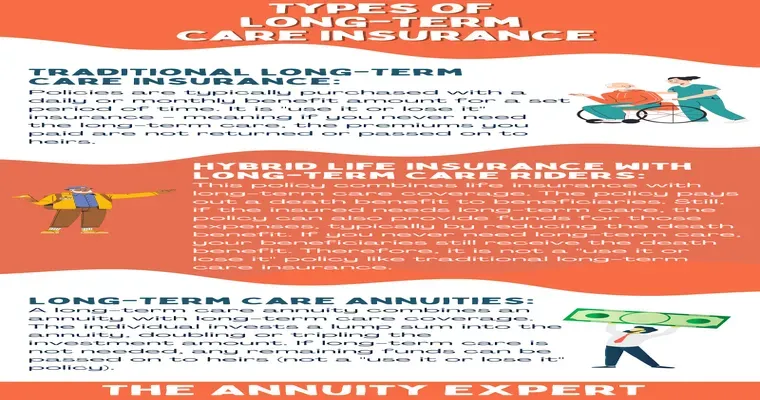

Explore Alternatives

Introduce the idea of exploring alternative options. There are different types of "insurance plans" available that may better suit her current situation. Discuss possibilities such as downsizing her coverage or switching to a more affordable plan. Showing her that there are alternatives can help her feel more in control of her decisions.

Encourage Professional Advice

If the conversation becomes too complex, suggest seeking advice from a financial advisor or insurance professional. An expert can provide a neutral perspective and help her make informed decisions regarding her "life insurance". Encourage her to ask any questions she may have, ensuring that she feels comfortable with the information she receives.

Reassure Her of Your Support

Throughout the conversation, reassure her that you are there to support her, no matter what decision she makes regarding her "insurance policy". Let her know that your primary concern is her financial security and overall well-being. This will help foster trust and make her more receptive to discussing her options.

Follow Up

After your initial conversation, check in with her to see how she feels about everything discussed. This will show her that you genuinely care and are willing to support her in whatever decision she makes. Open the door for further discussions if she has more questions or concerns.

In conclusion, approaching your mother about the need to reconsider her "life insurance plan" requires sensitivity and understanding. By discussing financial realities, explaining policy details, exploring alternatives, and encouraging professional advice, you can help her make an informed choice. Remember to reassure her of your support throughout the process. With patience and empathy, you can help her navigate this important decision.