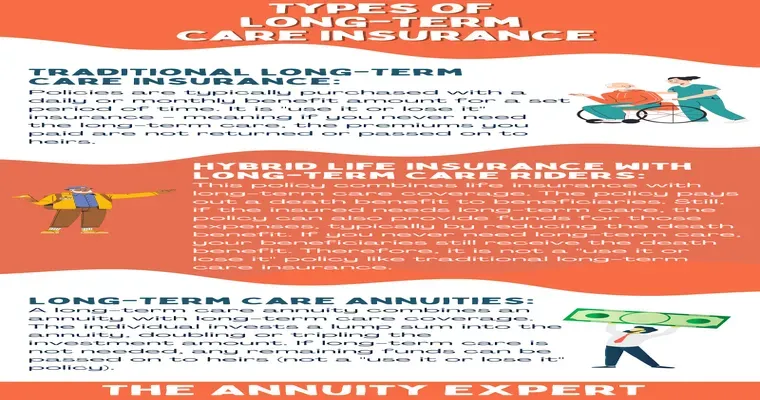

Navigating "Medicaid eligibility" can be a complex process, especially when it comes to understanding how "whole life insurance" policies, particularly those with cash value, are evaluated. For individuals seeking long-term care, understanding the implications of their life insurance policies is crucial. In this article, we will explore how whole life insurance, whether it has paid up premiums or not, is valued for Medicaid eligibility and what it means for your financial planning.

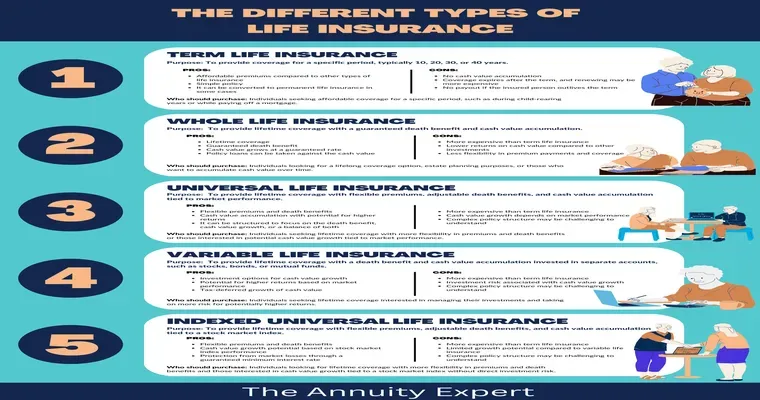

Understanding Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire life, as long as premiums are paid. One of the key features of whole life insurance is its "cash value", which accumulates over time and can be accessed by the policyholder. This cash value can be a significant asset, especially for those considering "Medicaid" for long-term care services.

Medicaid Eligibility and Asset Limitations

To qualify for Medicaid, applicants must meet specific financial criteria, including asset limitations. In most states, the asset limit for an individual is around two thousand dollars, but this can vary. "Life insurance policies" with cash value count as an asset when determining eligibility. Understanding how these policies are valued is essential for anyone looking to qualify for Medicaid assistance.

Valuation of Whole Life Insurance Policies

When evaluating whole life insurance for Medicaid eligibility, the following considerations come into play:

1. "Cash Value Assessment": The cash value of the whole life insurance policy is typically counted as an asset. Medicaid will assess the policy's current cash value, which can be found on the policy statement. This cash value is included in the total asset calculation.

2. "Face Value Consideration": If the cash value of the whole life insurance policy is less than a specific amount, some states may not count the policy against the asset limit. For example, if the face value of the policy is below a certain threshold, it may be exempt from being counted as an asset.

3. "Paid Up Premiums": Policies with paid up premiums, where the policyholder has stopped making regular premium payments but retains coverage, can also be evaluated. These policies still have cash value and are treated similarly to regular whole life policies. It is essential to understand that the cash value is what will be considered, regardless of whether premiums are still being paid.

4. "Transfer of Assets": If an individual has transferred assets, including life insurance policies, within a specified look-back period (usually five years), Medicaid may impose penalties. This means that if the policy was gifted or sold for less than its fair market value, it could affect Medicaid eligibility.

Strategies to Manage Whole Life Insurance for Medicaid Eligibility

Understanding how whole life insurance is valued for Medicaid can help individuals make informed decisions. Here are some strategies:

"Consult with a Medicaid Planner": A qualified Medicaid planner can help you understand the specific rules in your state and guide you on how to manage your assets effectively.

"Consider Policy Loans": If you need to reduce your cash value for Medicaid eligibility, you may consider taking a loan against your cash value. However, be aware that this could affect the death benefit.

"Review Policy Options": If you have a whole life insurance policy with a significant cash value, you might explore options such as converting it to a term policy or selling it through a life settlement, which can free up cash without impacting Medicaid eligibility.

Conclusion

Whole life insurance policies, especially those with cash value, play a significant role in determining Medicaid eligibility. Understanding how these policies are valued is crucial for effective financial planning, particularly for those anticipating long-term care needs. By being proactive and seeking professional guidance, you can navigate the complexities of Medicaid eligibility and ensure that your financial resources are managed wisely.