In today's healthcare landscape, many individuals are realizing that there are not as many options for good "long-term health care insurance" as there once were. With the rising costs of medical care and the increasing complexity of insurance plans, it can be challenging to find policies that offer comprehensive coverage at an affordable price. However, there are still viable options for those seeking protection against the costs associated with long-term care.

One of the most popular and effective options available today is "traditional long-term care insurance". These policies are designed to cover a range of services, including home health care, assisted living, and nursing home care. While premiums can vary based on factors like age and health, investing in a traditional policy can provide substantial peace of mind. It is essential to shop around and compare quotes from different providers to find a plan that fits your budget and needs.

Another option to consider is "hybrid long-term care insurance". These policies combine life insurance with long-term care benefits. If you never require long-term care, your beneficiaries receive a death benefit when you pass away. This dual benefit can make hybrid policies an attractive choice for those who want to ensure their loved ones are taken care of financially, even if they do not use the long-term care component.

For those who are looking for more flexibility, "short-term care insurance" may be a suitable alternative. Short-term care policies typically cover care for a limited duration, usually up to a year. While they do not provide the extensive coverage that long-term policies do, they can be a more affordable option for individuals who may only need temporary assistance after a medical event or surgery.

Additionally, some people may consider using "health savings accounts" (HSAs) or "flexible spending accounts" (FSAs) to help cover long-term care expenses. While these accounts do not provide insurance coverage, they allow you to set aside pre-tax dollars for qualified medical expenses, which can include certain long-term care services. This can provide a financial cushion, especially if you anticipate needing care in the future.

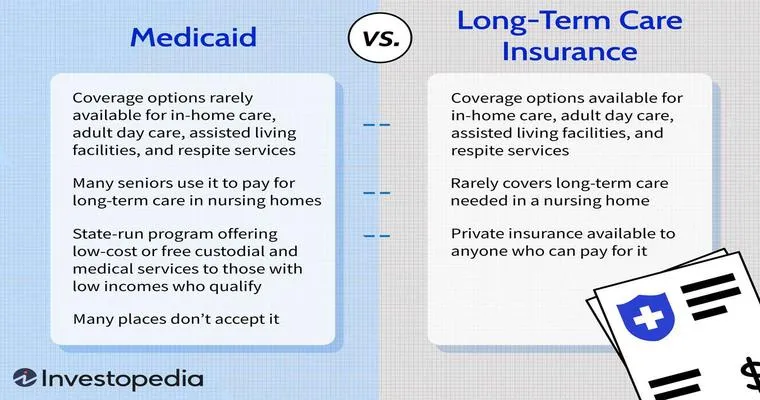

It is also worth exploring "Medicaid" as an option for long-term care. Although Medicaid has strict eligibility requirements, it can be an invaluable resource for those who meet the criteria. It provides coverage for a wide range of long-term care services, but it is crucial to understand the application process and potential asset limitations.

In conclusion, while there may be fewer options for good "long-term health care insurance" available today, there are still several choices worth considering. Whether you opt for traditional long-term care insurance, hybrid policies, short-term care insurance, or utilize savings accounts and Medicaid, it is essential to evaluate your unique situation and needs. By doing thorough research and consulting with a financial advisor or insurance expert, you can find a solution that provides the necessary coverage for your long-term health care needs.