If you purchased a "long term care insurance policy" three decades ago for "$1,500 per year", only to see your premiums skyrocket to "$19,200 annually", you are not alone. Many policyholders are grappling with the rising costs of long term care insurance as companies adjust their rates to remain financially viable. This situation can be distressing, especially when planning for future healthcare needs. Here are some options to consider if you find yourself facing this dilemma.

First, it is essential to understand why your premiums have increased so dramatically. Over the years, many insurance providers have raised their rates due to several factors, including lower than expected investment returns, increased longevity, and higher-than-anticipated claims. These factors have led to a trend of rising costs for long term care insurance, leaving many policyholders questioning their financial decisions.

One of the first steps you should take is to "review your policy". Check the terms and conditions to see if there are options available to adjust your coverage or premiums. Some companies allow policyholders to modify their benefits, which can help lower annual costs. For instance, you might consider reducing the daily benefit amount or the duration of coverage. While this may not be ideal, it can make your premiums more manageable.

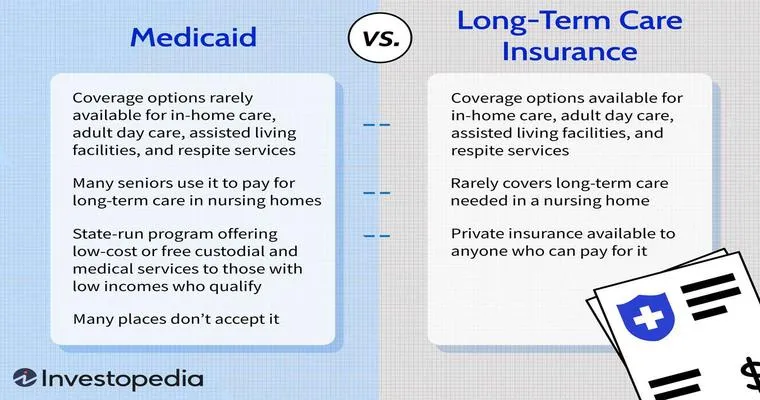

Another option is to "shop around". The long term care insurance market is constantly evolving, and it may be beneficial to compare your current policy with other options available in the market. Some insurers may offer more competitive rates for similar coverage, allowing you to switch without sacrificing necessary benefits. However, be cautious when switching policies, as pre-existing conditions may impact your eligibility or premium rates.

Consider reaching out to a "financial advisor or insurance agent" who specializes in long term care insurance. They can provide guidance tailored to your specific situation and help you explore potential alternatives, such as hybrid policies that combine long term care insurance with life insurance. These hybrid options often provide more flexibility and may help mitigate rising costs in the long term.

If the rising premium is becoming unmanageable, you may also want to consider whether you can afford to "self-insure". This means setting aside funds to cover potential long term care expenses instead of relying solely on insurance. Evaluating your financial situation and determining whether you have sufficient savings to cover future care needs is an important step in this process.

Lastly, consider the possibility of "reducing your coverage". If you find that the benefits of your current policy far exceed your needs, you might opt to scale back your coverage. This decision should be made with careful consideration of your health, family history, and potential future needs.

In conclusion, facing skyrocketing premiums on a long term care insurance policy can be daunting, but it is essential to take proactive steps to manage the situation. By reviewing your policy, shopping around for better options, consulting with a financial expert, evaluating self-insurance, and considering coverage adjustments, you can navigate the complexities of long term care insurance and ensure that you are prepared for the future. Always remember that making informed decisions now can save you significant stress and financial strain down the road.