Losing a spouse is an incredibly difficult experience, and navigating the "survivor's pension" process can feel overwhelming during such a challenging time. If you are applying for a "survivor's pension" after your spouse passed away in December, understanding the steps involved can help ease some of your burdens. This article aims to provide you with essential information and practical hints to guide you through the process, ensuring you access the support you need.

Understanding Survivor's Pension

A "survivor's pension" is a financial benefit provided to the surviving spouse or dependents of a deceased individual. The eligibility for this pension often depends on the deceased's work history, contributions to social security, or specific pension plans. It is crucial to gather all necessary documents before initiating the application process.

Essential Documents Needed

When applying for a "survivor's pension", you will typically need the following documents:

1. "Death Certificate": This is a primary document required to prove your spouse's passing.

2. "Marriage Certificate": To establish your relationship, you will need to submit proof of marriage.

3. "Identification": A government-issued ID such as a driver's license or passport is often required.

4. "Financial Records": Depending on the pension plan, you may need to provide information about your spouse's employment history and contributions.

Application Process

1. "Contact the Relevant Agency": Start by contacting the agency or organization that manages the pension plan. This could be a government agency, an employer's retirement plan, or a private pension provider.

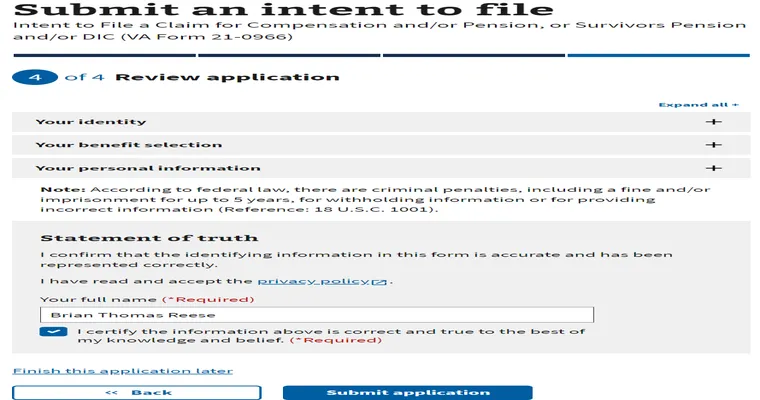

2. "Complete the Application Form": Obtain and fill out the application form for the "survivor's pension". Ensure all information is accurate and complete to avoid delays in processing.

3. "Submit Your Application": After gathering all necessary documents and completing the application, submit it according to the instructions provided by the agency. Keep copies of everything for your records.

4. "Follow Up": After submission, it's essential to follow up with the agency to check the status of your application. This can help you address any potential issues early in the process.

Tips for a Smooth Process

"Stay Organized": Keep a dedicated folder with all your documents and correspondence related to the "survivor's pension" application. This will make it easier to find information when needed.

"Seek Assistance": If you find the process confusing, consider reaching out to a financial advisor or a legal professional who specializes in pensions and benefits. They can provide valuable insights and support.

"Be Prepared for Delays": Processing times can vary, so be patient and prepared for potential delays. Regularly check in with the agency for updates.

"Understand Your Rights": Familiarize yourself with your rights regarding the "survivor's pension". Knowing what you are entitled to can help advocate for yourself during the process.

Conclusion

Applying for a "survivor's pension" after the loss of a spouse can be a daunting task, but understanding the process and gathering the necessary documents can significantly ease your journey. By staying organized, seeking assistance when needed, and being informed about your rights, you can navigate this process more effectively. Remember, you are not alone during this difficult time, and there are resources available to help you through it. TIA for any further insights or experiences you may wish to share as you embark on this journey.