As families face the challenges of caring for their elderly loved ones, particularly a "100-year-old granny" who is about to run out of money, it is crucial to explore all available options for financial assistance. "VA benefits", social security, and other financial resources can play a pivotal role in ensuring that your grandmother receives the care and support she needs during her golden years. Here are some steps you can take and considerations for maximizing her benefits.

Understanding VA Benefits

If your grandmother is a veteran or the widow of a veteran, she may be eligible for a range of "VA benefits". The "Veterans Affairs" department offers several programs designed to assist elderly veterans financially. The most relevant benefits may include:

1. "Pension Benefits": These benefits provide financial support to low-income veterans and their families. Eligibility depends on various factors, including income level and service history.

2. "Aid and Attendance": This program is specifically designed for veterans who require assistance with daily living activities. It can help cover the costs of in-home care, assisted living, or nursing home expenses.

3. "Health Care Services": The VA provides a variety of healthcare options for veterans, which can significantly reduce medical expenses.

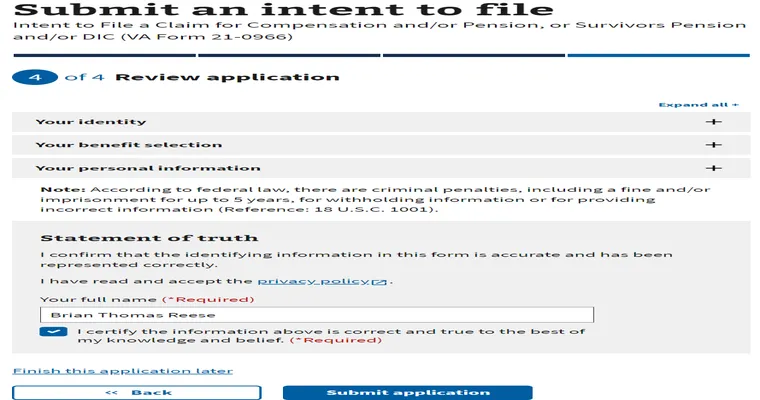

To apply for these benefits, you will need to gather necessary documentation, including military discharge papers and proof of financial need.

Exploring Other Financial Assistance Programs

In addition to VA benefits, consider other options that can help support your grandmother financially:

1. "Social Security Benefits": Ensure that she is receiving her full "Social Security" benefits. If she has not yet claimed her benefits, it is essential to check eligibility and file an application.

2. "Medicaid": If her income is low enough, she may qualify for "Medicaid", which can cover medical expenses and long-term care services. Each state has its own eligibility criteria, so it’s important to research the specific requirements.

3. "Supplemental Nutrition Assistance Program (SNAP)": This program can help her afford groceries and ensure she is getting proper nutrition, which is vital for her health.

4. "Local Assistance Programs": Many communities offer "local assistance programs" that provide financial help or resources for senior citizens. Research organizations in your area that cater to the elderly, such as the Area Agency on Aging.

Consider Legal and Financial Planning

As your grandmother approaches her centenary, it may be wise to consult with an elder law attorney or a financial planner who specializes in geriatric issues. They can help you navigate the complexities of "estate planning", long-term care insurance, and other financial matters. This can ensure her assets are protected and that she receives the maximum benefits available.

Staying Informed and Engaged

Lastly, staying informed about changes in "benefits" and resources is crucial. Laws and programs can evolve, so regularly checking for updates from the VA, Social Security Administration, and local agencies will keep you in the loop. Additionally, engaging with local senior centers can provide valuable information and support networks for your grandmother.

Conclusion

Caring for a "100-year-old granny" who is about to run out of money can be daunting, but by proactively pursuing "VA benefits", exploring other financial assistance programs, and seeking professional advice, you can ensure that she receives the care and support she deserves. Taking these steps will not only alleviate financial stress but also enhance her quality of life in her twilight years.