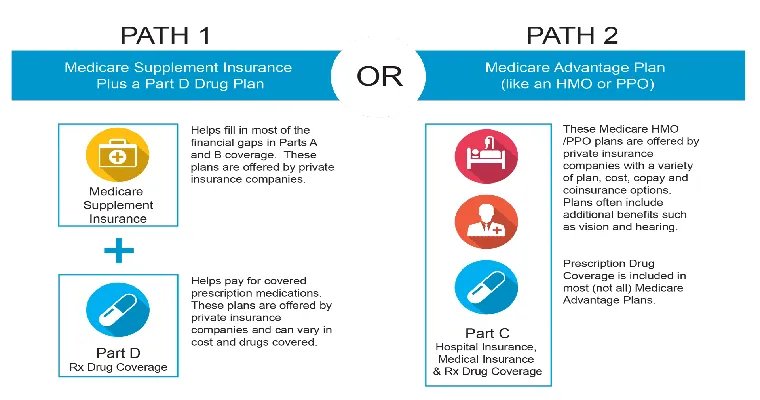

Navigating the world of "Medicare" can be overwhelming, especially when considering the various options available for supplementing your coverage. One of the most common options is "Medigap plans", which are designed to help cover the "out-of-pocket costs" that Original Medicare doesn't pay. Understanding when these plans make sense can help you make informed decisions about your healthcare needs and financial situation.

What are Medigap Plans?

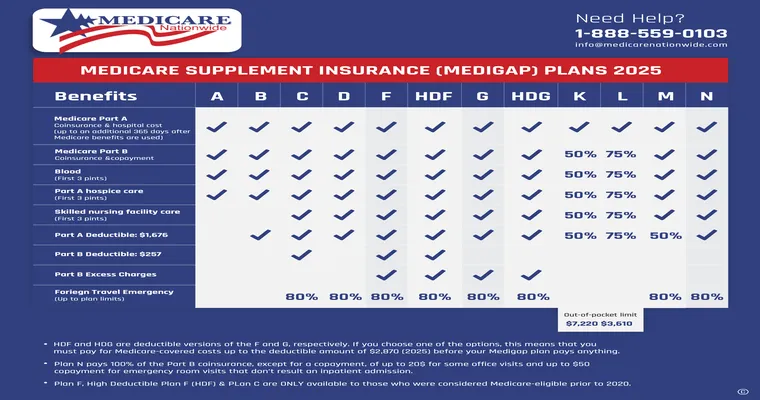

"Medigap plans", also known as Medicare Supplement plans, are private insurance policies that help pay for certain costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles. These plans are standardized in most states, meaning that the benefits offered by each plan type (A through N) are the same, regardless of the insurance company selling them.

When Should You Consider Medigap Plans?

1. "High Out-of-Pocket Costs": If you frequently find yourself facing substantial medical bills, a Medigap plan can significantly reduce your financial burden. These plans cover a variety of expenses that can quickly add up, providing peace of mind.

2. "Frequent Doctor Visits": For those who require regular medical care or have chronic health conditions, a Medigap plan can be a wise choice. It ensures that you have predictable costs when visiting healthcare providers, which can be especially beneficial if you see specialists often.

3. "Traveling Outside the U.S.": Original Medicare does not cover healthcare services outside the United States. Some Medigap plans offer coverage for emergency medical care when you travel abroad, making them an excellent option for retirees who love to travel.

4. "Preference for Flexibility in Provider Choice": Medigap plans allow you to see any doctor or specialist that accepts Medicare, offering more freedom compared to some Medicare Advantage plans that may have network restrictions.

5. "Desire for Comprehensive Coverage": If you want to minimize your exposure to unexpected healthcare costs, enrolling in a Medigap plan can provide comprehensive coverage. Some plans cover all out-of-pocket costs, ensuring you have no surprises when it comes to medical expenses.

Potential Drawbacks of Medigap Plans

While Medigap plans offer numerous benefits, they may not be suitable for everyone. It's essential to consider the following:

"Monthly Premiums": Medigap plans come with a monthly premium, which can add to your overall healthcare costs. It is crucial to assess whether the benefits outweigh the costs based on your individual health needs.

"No Prescription Drug Coverage": Medigap plans do not include prescription drug coverage. You may need to enroll in a separate "Medicare Part D" plan to cover your medication costs, which could further increase your monthly expenses.

"Eligibility and Enrollment Periods": To get the best rates and avoid medical underwriting, it’s ideal to enroll in a Medigap plan during your "Medicare Open Enrollment Period", which begins when you turn 65 and enroll in Medicare Part B. Waiting until after this period may limit your options or lead to higher premiums.

Conclusion

Medigap plans can be a valuable addition to your "Medicare coverage" if you find yourself facing high out-of-pocket costs, require frequent medical services, or desire greater flexibility in choosing healthcare providers. Evaluating your healthcare needs, financial situation, and lifestyle can help determine whether a Medigap plan makes sense for you. As always, speaking with a licensed insurance agent can provide personalized insights and help you navigate your options effectively.