Losing a loved one, especially a "mother-in-law", can be an incredibly challenging experience. This year, my "MIL passed away" in July while residing in a "memory care facility". In addition to dealing with the emotional impact of her loss, our family faced the task of managing her financial affairs, which included an "annuity" and an "insurance policy". A portion of these funds was allocated for her burial expenses, making it imperative to understand how to navigate these financial matters during such a difficult time.

In the wake of her passing, one of the first steps we took was to review her "insurance policy". This policy was crucial not only for covering burial expenses but also for understanding any additional benefits that could assist our family during this transition. It is essential to contact the insurance provider as soon as possible to initiate the claims process, gather necessary documentation, and ensure that all claims are filed promptly.

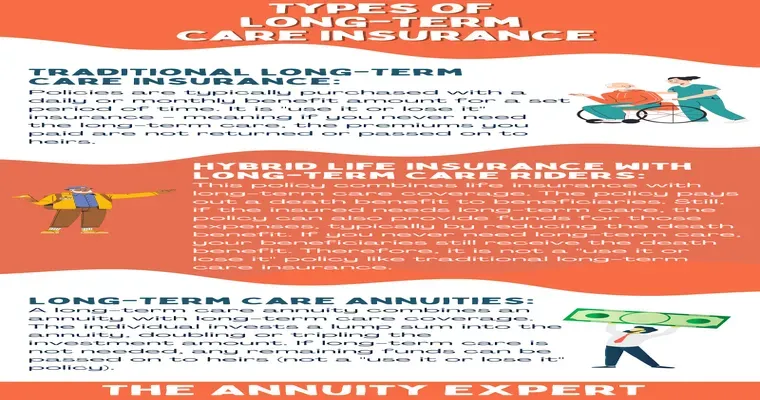

The "annuity" my MIL held also played a significant role in our financial planning after her death. Annuities can provide a steady income stream, and understanding how this asset works is vital for beneficiaries. We consulted with a financial advisor to discuss the best ways to manage these funds while honoring her memory and ensuring the financial security of our family.

Moreover, dealing with the logistical aspects of a loved one’s passing can be overwhelming. We found it helpful to create a checklist of tasks that needed to be completed, which included arranging for the burial, notifying relevant organizations, and managing her estate. This structured approach helped us stay organized amidst the emotional turmoil.

During this period, we leaned heavily on support systems, including family and friends, who provided both emotional and practical assistance. Sharing our experiences and challenges with others who have faced similar situations offered comfort and guidance. We also looked for bereavement support groups that could provide additional resources for coping with loss.

In conclusion, the experience of losing my "mother-in-law" has been a profound journey of grief and resilience. While the emotional pain is still fresh, understanding the financial implications of her passing—specifically regarding her "annuity" and "insurance policy"—has helped us navigate this challenging time. It is crucial to address these financial matters promptly while also ensuring that we honor her memory in our lives. If you find yourself in a similar situation, remember that seeking help and leaning on your support network can make a significant difference as you navigate through grief and financial responsibilities.