Navigating the complexities of "health insurance" can be incredibly challenging, especially when faced with a situation where your loved one’s "insurance provider" has denied future coverage. This is what my family is currently experiencing. Last Monday, we filed an "appeal" against the denial, as my mom was scheduled for discharge from the hospital on Thursday. Understanding the implications of this decision and the steps we can take is crucial for ensuring she receives the care she needs.

When an insurance company decides to deny coverage, it can feel like an uphill battle. It is essential to thoroughly understand the reasons behind the denial. Common reasons include lack of medical necessity, incomplete documentation, or services not covered under the specific policy. In our case, we believe the denial was not justified, which is why we immediately initiated an appeal process.

The appeal process is a critical step in advocating for the necessary medical care. During the appeal, we collected all relevant "medical records", statements from healthcare providers, and any additional documentation that could support our case. It is vital to clearly communicate the medical necessity of the treatment being provided and to highlight any urgency associated with the situation.

Additionally, keeping a detailed record of all communications with the insurance provider is essential. This includes dates, times, and the names of the representatives spoken to. This documentation can be invaluable if further action is required, such as escalating the appeal to a higher authority within the insurance company or even seeking external assistance.

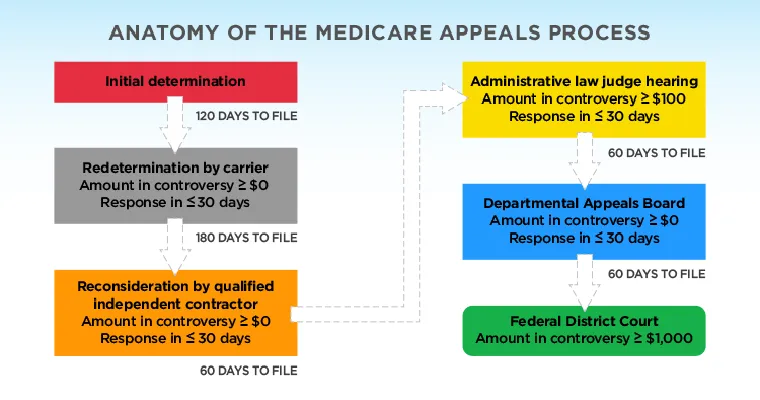

If the appeal is denied, there are still options available. Patients and families can request an external review, where an independent third party evaluates the case. This external review can often provide a fresh perspective and lead to a different outcome.

Moreover, understanding your rights as a patient is crucial. The Affordable Care Act provides certain protections that can help in situations like these. Patients have the right to appeal decisions made by their insurance providers, and they should not hesitate to exercise those rights.

In conclusion, while the denial of future coverage for my mom's insurance is a daunting challenge, it’s important to stay proactive and informed. By submitting a thorough appeal, documenting all interactions, and knowing our rights, we can work towards securing the necessary coverage for her ongoing care. If you or a loved one finds yourselves in a similar situation, remember that you are not alone, and there are resources available to help navigate the insurance landscape.