As our loved ones age, "financial concerns" can become increasingly pressing, especially when it comes to elder care. If your mother is "95 years old and living in an assisted living facility", you may be worried about her "financial stability" and the possibility that she could "outlive her money". This is a common concern among families facing similar situations. Fortunately, there are several options and strategies to consider to ensure that your mother receives the care she needs without depleting her financial resources.

Understanding Costs of Assisted Living

Before exploring options, it's essential to understand the "costs associated with assisted living". These facilities provide various services, including meals, housekeeping, and personal care, which can vary significantly in price depending on location and level of care required. Knowing the monthly expenses can help you assess how long your mother's current savings and income will last.

Evaluating Financial Resources

Begin by evaluating your mother’s current "financial resources". This includes her savings, income from pensions, Social Security benefits, and any other assets she may possess. A clear understanding of her financial situation will help you determine how much longer she can afford her current living arrangement.

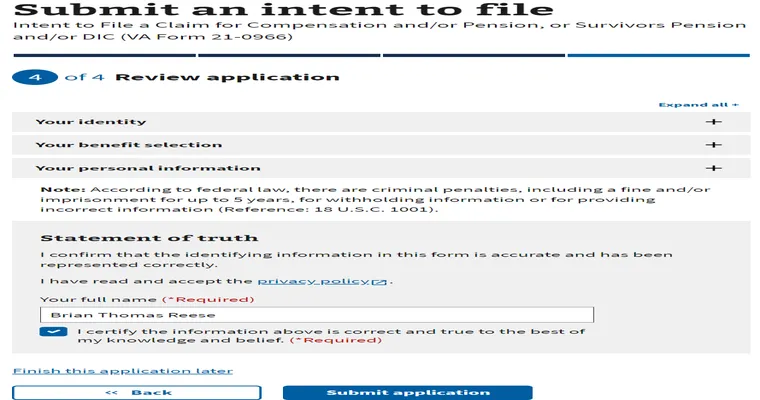

Exploring Government Assistance Programs

One of the first avenues to explore is government assistance programs. Depending on your mother’s income and assets, she may qualify for programs such as Medicaid, which can help cover some of the costs associated with assisted living. Medicaid eligibility varies by state, so it is essential to research the guidelines specific to where your mother resides.

Long-Term Care Insurance

If your mother has "long-term care insurance", check the policy details. Some policies may cover the costs of assisted living, while others may only apply to nursing home care. Understanding the terms of her policy can provide insight into available financial support.

Asset Protection Strategies

If you are concerned that your mother may outlive her money, consider implementing asset protection strategies. This could involve restructuring her assets to qualify for government assistance programs or protecting her wealth against potential depletion. Consulting with a financial advisor or elder law attorney is advisable to navigate these options effectively.

Family Support and Involvement

Sometimes, family support can make a significant difference. If possible, discuss with family members the option of contributing financially to your mother’s care. This could involve regular monetary support or even taking on certain caregiving responsibilities to reduce her overall costs.

Downsizing and Relocation

If the costs of her current assisted living facility are unsustainable, consider exploring other living arrangements. Downsizing to a smaller, more affordable facility or even a different type of housing arrangement, such as independent living or shared housing, could help alleviate financial burdens while still providing necessary care.

Financial Planning and Budgeting

Creating a detailed "financial plan" and budget can also be beneficial. This plan should outline her income, expenses, and any potential changes in her financial situation. Regularly reviewing this budget will help you stay ahead of any potential shortfalls and adjust as necessary.

Conclusion

Caring for an aging parent can be challenging, especially when it comes to ensuring their financial security. If your mother is "95 years old and living in an assisted living facility", and you worry that she might "outlive her money", remember that there are various options available to you. By exploring government assistance programs, evaluating her financial resources, and considering family support, you can help secure her future and ensure she receives the care she deserves. Taking proactive steps now can lead to better outcomes and peace of mind for both you and your mother.