As seniors embark on their "travel adventures", the importance of having comprehensive health coverage cannot be overstated. Many may wonder if a "Medigap policy" is necessary for their trips. Medigap, also known as Medicare Supplement Insurance, helps cover some of the healthcare costs that Original Medicare does not, such as copayments, coinsurance, and deductibles. For seniors planning to travel, understanding whether a Medigap policy is beneficial can make a significant difference in ensuring peace of mind during their journeys.

Understanding Medigap Policies

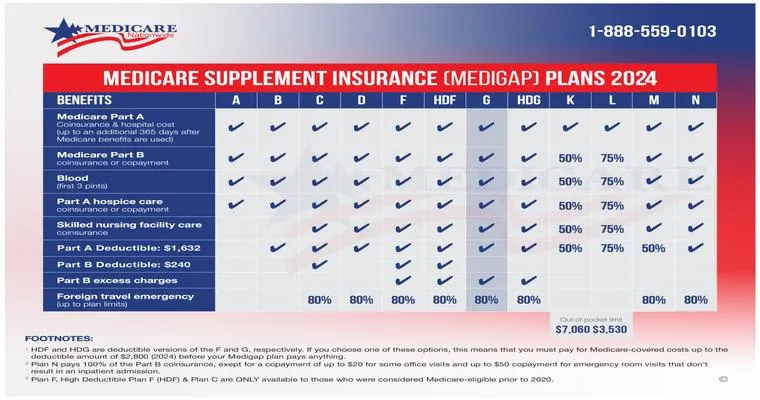

Before delving into the necessity of a Medigap policy for travel, it is crucial to comprehend what these plans offer. Medigap policies are designed to fill the gaps in Medicare coverage, which is especially relevant for seniors who may require medical attention while on the go. These policies are standardized across states, meaning that the benefits provided by each plan are consistent, although premiums may vary.

Why Consider a Medigap Policy for Travel?

Traveling can sometimes lead to unexpected health issues. For seniors, the risk of needing medical care while away from home can be higher due to age-related health concerns. Here are a few reasons why obtaining a Medigap policy is worth considering:

1. "Coverage for Emergency Situations": If a senior requires emergency medical treatment while traveling, a Medigap policy can help cover costs that Original Medicare may not pay, especially if the treatment is outside of their home state.

2. "Peace of Mind": Knowing that there is financial protection against unforeseen medical expenses allows seniors to enjoy their travels without the constant worry of potential health issues.

3. "Access to a Wider Network of Providers": Some Medigap plans allow for a broader range of healthcare providers, which can be beneficial when traveling to different states or regions.

Limitations of Medigap Policies

While Medigap policies offer numerous benefits, there are some limitations to consider. For instance, Medigap does not cover long-term care, vision or dental care, or hearing aids. Additionally, these policies are not applicable in certain situations, such as traveling outside the United States, unless specific coverage is included.

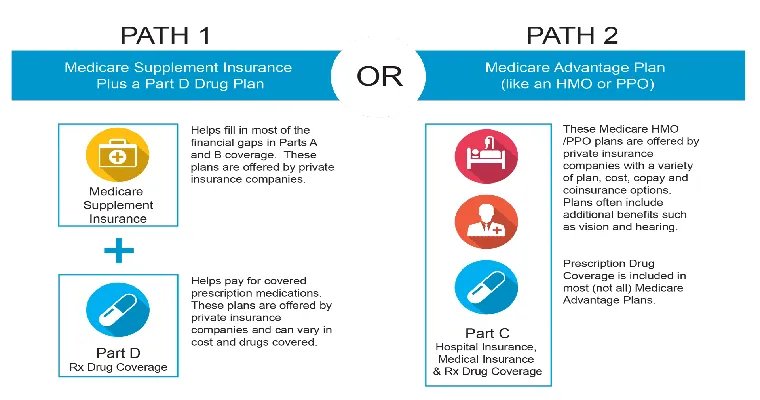

Alternatives to Medigap for Travelers

Seniors may also consider alternative options when it comes to health insurance for travel. Some might find that a "travel insurance policy" can provide adequate coverage for medical emergencies during their trips. Travel insurance often covers emergency medical expenses, trip cancellations, and lost belongings, making it an appealing choice for those who travel frequently.

Making the Decision

Ultimately, the decision to purchase a Medigap policy for travel should be based on individual health needs, travel frequency, and budget considerations. Seniors should assess their current Medicare coverage and determine if the additional benefits of a Medigap policy align with their travel plans. Consulting with a health insurance advisor can also provide valuable insights tailored to personal circumstances.

Conclusion

In conclusion, as seniors plan their future travels, considering a "Medigap policy" could enhance their travel experience by providing essential health coverage. With the potential for unexpected medical needs while away from home, having a Medigap policy can offer significant advantages, ensuring that seniors can focus on enjoying their adventures. Whether through a Medigap plan or alternative travel insurance, the right choice can lead to a more secure and enjoyable travel experience.