Navigating the complexities of "Medicaid spend-down rules" can be particularly challenging for married couples, especially in the context of "spousal impoverishment". When one spouse requires long-term care, it can create financial strain on the couple, leading to questions about how to protect their assets while securing necessary healthcare benefits. Understanding the rules surrounding spousal impoverishment is crucial for ensuring that both partners maintain a certain level of financial security.

Understanding Spousal Impoverishment

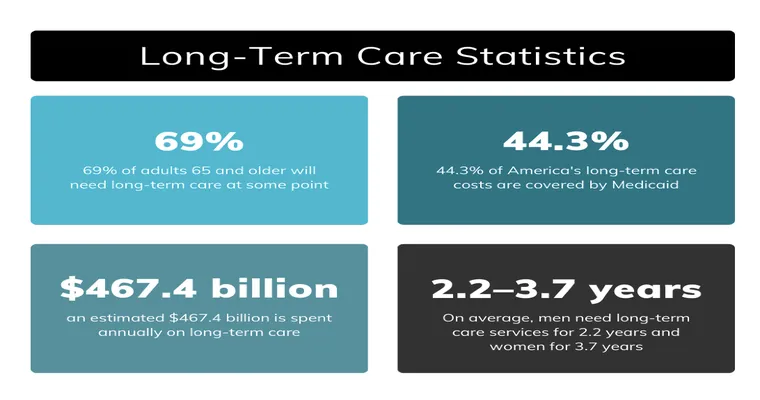

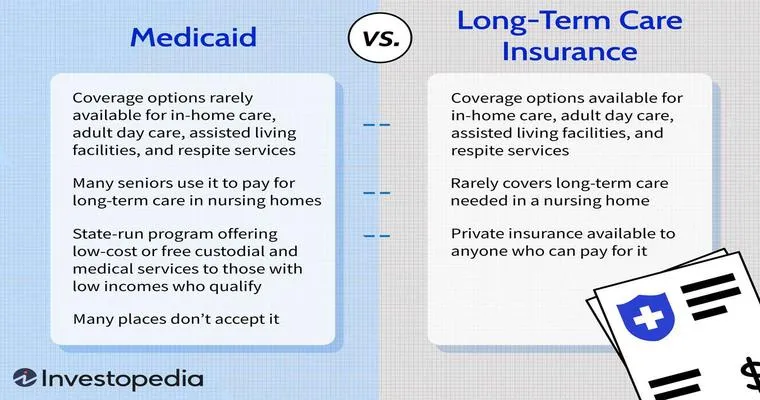

Spousal impoverishment refers to the situation where one spouse is institutionalized while the other remains in the community. In this scenario, the spouse who requires long-term care may need to apply for Medicaid to cover the costs of their care. However, Medicaid has specific rules to prevent the community spouse from becoming impoverished as a result of the institutionalized spouse's care costs. This is where the "Medicaid spend-down rules" come into play.

Medicaid Spend-Down Rules Explained

The Medicaid spend-down rules allow married couples to retain a portion of their assets and income, thereby preventing the community spouse from facing financial hardship. These rules vary by state, but generally, the following provisions apply:

1. "Asset Protection": Medicaid allows the community spouse to retain a certain amount of assets without jeopardizing the institutionalized spouse's eligibility. This is often referred to as the Community Spouse Resource Allowance (CSRA). The CSRA limit varies by state and can be a significant amount, providing essential financial security for the community spouse.

2. "Income Allowance": In addition to asset protection, Medicaid also establishes an income allowance for the community spouse. This means that a portion of the couple’s combined income can be allocated to the community spouse to help cover living expenses.

3. "Spending Down Assets": If the couple’s combined assets exceed the allowable limits, they may need to "spend down" their assets to qualify for Medicaid. This can involve paying off debt, purchasing exempt assets (such as a primary residence or a vehicle), or covering medical expenses. It is essential to strategize this process carefully, as improper spending can lead to Medicaid penalties.

The Importance of Planning

Effective planning is critical when dealing with "spousal impoverishment" and Medicaid spend-down rules. Couples should consider consulting with a qualified elder law attorney or a financial planner who specializes in Medicaid planning. These professionals can provide guidance on how to protect assets, maximize benefits, and navigate the legal complexities involved.

Conclusion

Understanding the intricacies of "spousal impoverishment" and "Medicaid spend-down rules" is vital for married couples facing long-term care challenges. By being informed about asset protection, income allowances, and spend-down strategies, couples can work towards securing their financial future while ensuring that their healthcare needs are met. Proactive planning and professional guidance can make a significant difference in navigating these complex rules and protecting the well-being of both spouses.