When faced with the situation of your "mom running out of money" while living in an "assisted living" facility, it can be a daunting and emotional challenge. Especially if she is currently in a "1-bedroom" apartment and "Medicaid" only covers "studio" apartments, you may feel overwhelmed and unsure of your next steps. This article aims to provide you with practical advice on how to navigate this situation and ensure your mother receives the care she needs.

Assess Financial Resources

The first step is to assess your mother's "financial situation". Review her income sources, savings, and any assets she may have. This information will help you determine how long she can afford her current living arrangement and if there are any other financial resources available to her. Additionally, check if she qualifies for any other assistance programs that may help cover her expenses.

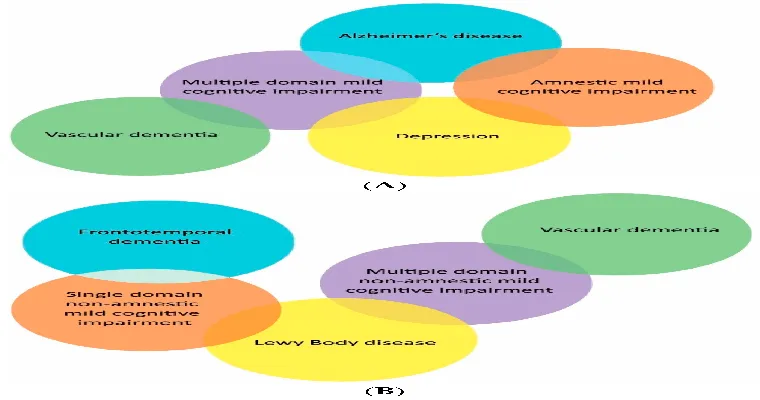

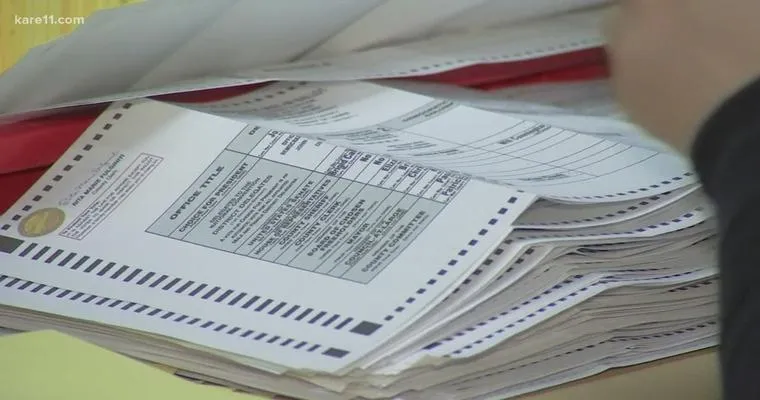

Explore Medicaid Options

Since your mother is already in an assisted living facility, it's essential to understand the "Medicaid" policies in your state. Medicaid rules regarding assisted living vary by state, and some states may have options for "waivers" or programs that cover the costs of a "1-bedroom" unit. Research these options and consult with a Medicaid specialist if necessary to explore possible solutions.

Consider Downsizing

If your mother can no longer afford her "1-bedroom" apartment, consider the option of downsizing to a "studio" apartment within the same facility. This change may allow her to continue living in a familiar environment while ensuring that her care needs are still met. Discuss this option with her and weigh the emotional and practical implications of such a move.

Look for Alternative Living Arrangements

If downsizing is not feasible, consider looking for alternative living arrangements. Other assisted living facilities or "senior housing" options may offer more affordable rates or better suit your mother’s financial situation. Research local options and inquire about their services, costs, and any financial assistance programs they may offer.

Seek Help from Family and Friends

Don’t hesitate to reach out to family members and friends for support. They may be willing to help financially or assist in finding resources for your mother. Discussing the situation openly can foster a supportive environment and may lead to creative solutions that you hadn’t considered.

Consult with a Financial Advisor

If you find the financial aspects overwhelming, consider consulting a "financial advisor" who specializes in elder care. They can provide tailored advice on how to manage your mother’s finances, navigate Medicaid, and explore other funding options. A professional can help you devise a plan that aligns with your mother’s needs and your family's financial capabilities.

Investigate Community Resources

Many communities offer resources for seniors facing financial hardships. Look into local nonprofits, charities, and government programs that may provide assistance for housing or healthcare costs. These resources can sometimes help cover the gap in expenses when traditional funding sources fall short.

Plan for the Future

Lastly, it’s essential to plan for the future. Discuss your mother’s long-term care needs and financial strategies with her while she is still able to participate in these conversations. Understanding her preferences will allow you to make informed decisions as her circumstances change.

In conclusion, navigating the complexities of assisted living and financial constraints can be challenging, especially when your mom runs out of money. By assessing her financial situation, exploring Medicaid options, considering downsizing, seeking help from family, consulting professionals, and investigating community resources, you can find a viable solution that ensures she receives the care she deserves. Taking proactive steps now will help alleviate stress and provide peace of mind for both you and your mother.