When it comes to filing your taxes, understanding what "medical expenses" can be written off can significantly impact your overall tax liability. Many taxpayers overlook the potential deductions available for "qualified medical expenses", which can help reduce taxable income and ultimately lower the amount owed to the IRS. In this article, we will explore various types of medical expenses that are eligible for tax deductions, helping you maximize your tax refund.

Understanding Qualified Medical Expenses

To qualify for a tax deduction, medical expenses must meet certain criteria set by the IRS. Generally, you can deduct the total qualified medical expenses that exceed 7.5 percent of your "Adjusted Gross Income (AGI)" for the tax year. This means if your AGI is $50,000, you can only deduct medical expenses that exceed $3,750.

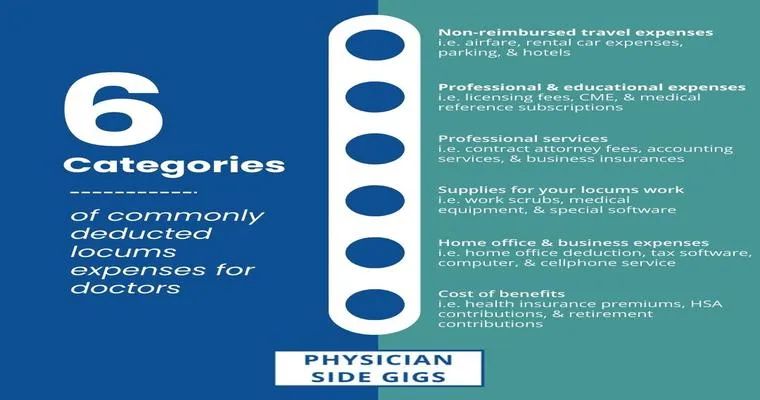

Types of Deductible Medical Expenses

1. "Health Insurance Premiums": You can deduct premiums paid for health insurance, including premiums for policies covering medical care, dental care, and long-term care insurance. This includes amounts paid through an employer-sponsored plan or individual policies.

2. "Out-of-Pocket Medical Expenses": Expenses such as doctor visits, hospital stays, and surgeries can be deducted. This also includes co-pays and deductibles associated with your health insurance.

3. "Prescription Medications": Costs incurred for prescription medications are fully deductible. However, over-the-counter medications are generally not deductible unless prescribed by a doctor.

4. "Medical Equipment and Supplies": If you purchase medical devices or supplies that are necessary for medical care, these costs can be deducted. This includes items such as wheelchairs, hearing aids, and diabetic supplies.

5. "Transportation Costs": If you travel for medical care, you can deduct transportation expenses. This includes mileage for using your car to travel to medical appointments, as well as expenses for public transportation or taxi services.

6. "Dental and Vision Expenses": Costs for dental procedures and vision care, including eyeglasses and contact lenses, are also eligible for deductions. This extends to orthodontic work and other necessary dental treatments.

7. "Home Improvements for Medical Needs": If you make modifications to your home for medical reasons, such as installing ramps or modifying bathrooms, these expenses may be deductible as well.

8. "Mental Health Services": Fees paid for therapy, counseling, and other mental health services are considered qualified medical expenses and can be deducted.

How to Document Your Medical Expenses

To claim these deductions, it is essential to keep detailed records of all medical expenses throughout the year. This includes receipts, invoices, and any other documentation that supports your claims. Additionally, maintaining a log of transportation expenses, including dates, mileage, and destinations, can help substantiate your deductions.

Conclusion

Understanding what "medical expenses" can be written off on your taxes can lead to significant savings at tax time. By keeping thorough records and knowing which expenses qualify, you can ensure you are taking full advantage of available deductions. Always consider consulting with a tax professional for personalized advice tailored to your financial situation, especially when it comes to navigating the complexities of tax deductions related to medical expenses. Maximizing your tax refund means being informed and proactive about your deductible "medical expenses".