Planning for "long-term care" is essential for couples as they navigate the complexities of aging together. It involves preparing for potential health issues and ensuring that both partners' needs are met. A proactive approach can prevent misunderstandings and financial strain in the future. Here are four crucial steps for successful long-term care planning with a spouse.

Step 1: Open Communication

The first step in effective long-term care planning is to establish "open communication" with your spouse. Discuss your individual needs, preferences, and concerns regarding health care as you age. It is vital to talk about how you envision your future, including your desires for care and living arrangements. This dialogue helps both partners understand each other's perspectives and fosters a supportive environment for planning.

Step 2: Assess Financial Resources

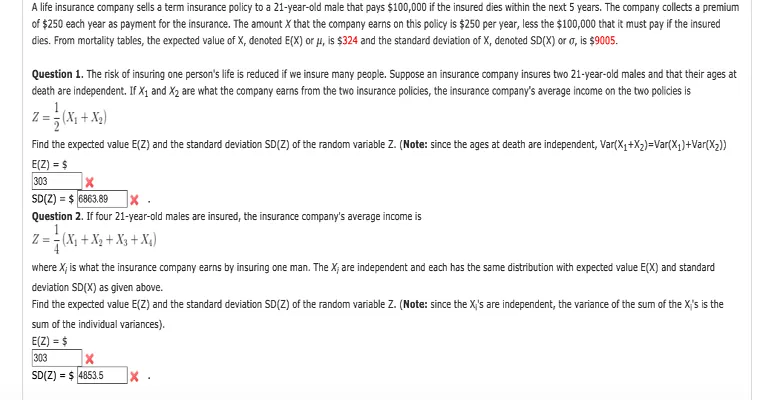

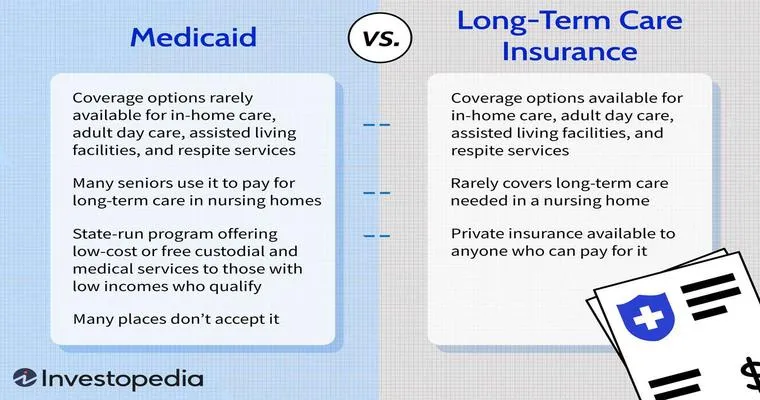

Once you have discussed your preferences, the next step is to assess your "financial resources". Review your current financial situation, including savings, investments, insurance, and pensions. It is also important to consider the costs associated with long-term care, which can vary widely depending on the type of care required. By understanding your financial landscape, you can make informed decisions about funding options, such as long-term care insurance or Medicaid.

Step 3: Explore Long-Term Care Options

After assessing your financial resources, explore various "long-term care options" available to you. This may include in-home care, assisted living facilities, or nursing homes. Each option has its advantages and disadvantages, so consider factors like cost, proximity to family, and the level of care required. Research local facilities and services, and take the time to visit them with your spouse to get a feel for what might work best for both of you.

Step 4: Create a Legal Plan

The final step in your long-term care planning process is to create a "legal plan" that outlines your wishes and protects both partners. This involves drafting essential documents such as powers of attorney, living wills, and healthcare proxies. These legal instruments ensure that your preferences are honored when you may no longer be able to communicate them. Consulting with a legal professional specializing in elder law can provide valuable guidance in creating a comprehensive plan.

By following these four steps—open communication, assessing financial resources, exploring long-term care options, and creating a legal plan—you can ensure that you and your spouse are well-prepared for the future. Successful long-term care planning fosters peace of mind and helps to strengthen your relationship as you navigate the challenges of aging together.