When contemplating the purchase of "long-term care insurance", it is essential to evaluate various factors that can significantly impact your decision. This type of insurance is designed to cover services that assist individuals with activities of daily living, such as bathing, dressing, and eating. Understanding these factors can help you make an informed choice that aligns with your financial and personal goals.

1. Understanding Your Needs

Before purchasing long-term care insurance, assess your current health status and family history. If you have a family history of chronic illnesses or disabilities, you may require long-term care sooner than you think. Consider your lifestyle and whether you might need assistance as you age.

2. Policy Types

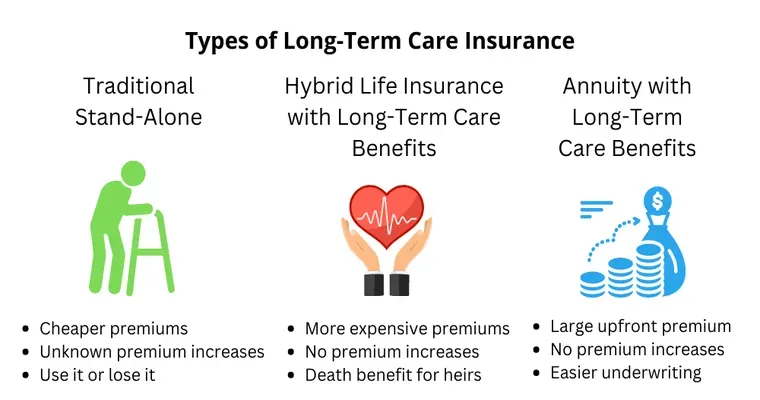

There are different types of long-term care insurance policies available, such as traditional policies and hybrid policies that combine life insurance with long-term care benefits. Research the types to find the option that best fits your needs. A traditional policy may offer comprehensive coverage, while a hybrid option can provide added security.

3. Coverage Benefits

Review the coverage benefits offered by various policies. This includes the types of care covered, such as in-home care, assisted living facilities, and nursing homes. Ensure that the policy you choose aligns with your anticipated care needs and preferences.

4. Elimination Period

The "elimination period", or waiting period, is the time you must wait before your benefits kick in. Evaluate how long you can afford to wait after needing care. Shorter elimination periods may result in higher premiums, so find a balance that works for your financial situation.

5. Daily Benefit Amount

Determine the "daily benefit amount" you’ll need for long-term care services. Research the average costs of care in your area to ensure that your policy will cover these expenses adequately. This amount should reflect the level of care you expect to use.

6. Premium Costs

Premiums can vary significantly between policies. Analyze your budget and what you can afford in terms of monthly or annual payments. Keep in mind that premiums can increase over time, so it is wise to understand how future costs may affect your financial planning.

7. Inflation Protection

Inflation can erode the value of your benefits over time. Look for policies that offer "inflation protection", which allows your benefit amounts to increase periodically. This feature can help ensure that your coverage remains relevant as healthcare costs rise.

8. Company Reputation

Finally, consider the reputation and financial stability of the insurance company. Research customer reviews and ratings to ensure that the provider is reliable and has a track record of honoring claims. A reputable company will offer peace of mind when you need to rely on your long-term care insurance.

In conclusion, purchasing long-term care insurance is a significant decision that requires careful consideration of multiple factors. By evaluating your needs, understanding policy options, and researching providers, you can make an informed choice that provides security for your future. Always consult with a financial advisor or insurance specialist to navigate this complex landscape effectively.