Filing for "fiduciary" for a "disabled parent" can be a daunting process, especially if you are unfamiliar with the legal terminology and requirements involved. Many individuals face the challenge of ensuring that their parents receive the appropriate care and financial management when they are no longer able to do so themselves. This article aims to provide valuable insights and guidance for those considering this important step.

Understanding Fiduciary Responsibilities

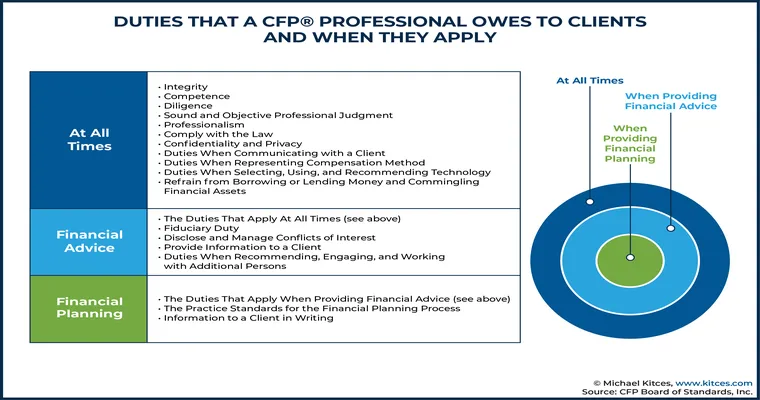

A fiduciary is someone who has the legal authority to make decisions on behalf of another person, particularly in matters concerning "financial management" and "healthcare". When it comes to a disabled parent, a fiduciary can help manage their assets, pay bills, and make medical decisions that align with the parent’s best interests. Understanding the different types of fiduciaries, such as guardians and conservators, is crucial in determining which role may be appropriate.

Assessing the Need for a Fiduciary

Before filing for fiduciary status, it is essential to evaluate whether your parent truly requires this level of assistance. This involves assessing their ability to manage their own "finances", make informed decisions, and care for their personal well-being. If your parent has a cognitive impairment, physical disability, or mental health issues, it may be necessary to seek a fiduciary.

The Filing Process

1. "Consult an Attorney": It is advisable to consult with an attorney who specializes in elder law or estate planning. They can guide you through the "legal procedures" and help you understand your responsibilities as a fiduciary.

2. "Gather Documentation": Prepare all necessary documentation, including medical records that demonstrate your parent’s disability, financial statements, and any existing wills or trusts. This information will be vital in proving the need for a fiduciary.

3. "File a Petition": Submit a petition to the appropriate court. This document will outline your request for fiduciary status and provide evidence of your parent’s condition. The court will review the petition and may schedule a hearing to discuss the matter further.

4. "Attend the Hearing": Be prepared to present your case at the hearing. The court may require you to answer questions regarding your ability to serve as a fiduciary and your parent’s needs. It is important to be honest and transparent during this process.

5. "Receive the Court’s Decision": After reviewing all evidence, the court will make a decision regarding your fiduciary status. If granted, you will receive legal authority to act on behalf of your parent.

Managing the Fiduciary Role

Once you are appointed as a fiduciary, it is essential to understand your responsibilities. This includes managing your parent’s "financial affairs", ensuring their basic needs are met, and making healthcare decisions that align with their wishes. Keeping accurate records and maintaining open communication with family members can help alleviate potential conflicts.

Conclusion

Filing for fiduciary status for a disabled parent is a significant decision that requires careful consideration and thorough preparation. By understanding the process and seeking the appropriate legal guidance, you can ensure that your parent receives the care and support they need. If you have personal experiences or insights to share about this journey, please feel free to contribute to the conversation. Your story could help others navigating similar challenges.