When applying for "fiduciary" roles, many candidates often wonder why their "credit history" is scrutinized during the process. Understanding the reasons behind this practice is crucial for individuals seeking fiduciary positions, as it directly impacts their eligibility and the perception of their "financial responsibility". In this article, we will explore the significance of credit checks in fiduciary applications and how it relates to the trust placed in these financial roles.

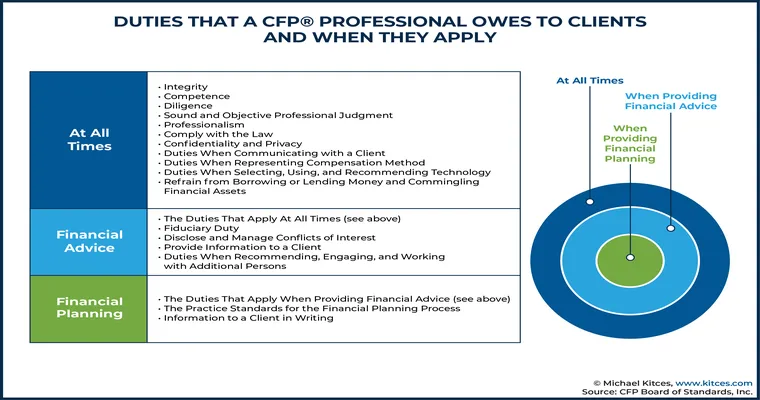

Fiduciaries are individuals or entities that manage assets or financial matters on behalf of another person or organization. This role comes with a significant amount of "responsibility", as fiduciaries are expected to act in the best interests of their clients. Because of this level of trust, financial institutions, and clients want assurance that the fiduciary will handle funds judiciously. One effective way to gauge a candidate’s reliability and integrity is through their credit history.

The rationale behind reviewing an applicant's credit report is straightforward. A poor "credit score" can indicate financial distress, irresponsibility, or a lack of organization. If a fiduciary is struggling with their own finances, it raises concerns about their ability to manage someone else’s assets effectively. Financial mismanagement could lead to significant losses for clients, which is why employers are keen on ensuring that fiduciaries maintain a healthy credit profile.

Additionally, the fiduciary role often involves handling large sums of money and making crucial financial decisions. When an applicant has a solid credit history, it suggests that they have experience managing finances and are less likely to engage in risky behavior that could jeopardize their clients' assets. Therefore, a clean credit report serves as a form of assurance for potential clients and employers alike.

Another important aspect to consider is the legal and regulatory framework surrounding fiduciary duties. In many jurisdictions, fiduciaries are required to adhere to strict ethical standards, which include maintaining transparency and accountability. A poor credit record can reflect negatively on a candidate's character and may suggest a tendency to act in self-interest rather than prioritize the needs of clients.

Moreover, credit checks can help identify potential "red flags" that may not be evident from a resume or interview alone. For instance, frequent late payments, bankruptcies, or high debt levels can signal a pattern of reckless behavior. Employers may view these issues as indicators that the candidate may not uphold the fiduciary standard of care required in the role.

In conclusion, the practice of holding credit against applicants in fiduciary positions is not merely a formality but a necessary step in ensuring that those entrusted with financial management are capable and trustworthy. A solid credit history reflects a candidate's ability to handle financial matters responsibly, which is paramount in building trust with clients. As you prepare for your fiduciary application, it is wise to review your credit report, address any issues, and present yourself as a responsible steward of financial resources. By doing so, you can increase your chances of securing the role and demonstrating your commitment to upholding the fiduciary standard.