Becoming a "fiduciary" for a friend, particularly a "veteran" who has no family support for his "financial affairs", is a noble commitment that requires understanding the responsibilities and legalities involved. Acting as a fiduciary means you will be entrusted with managing your friend's financial matters, ensuring they are handled responsibly and in their best interest. Here’s a guide to help you navigate this important role.

Understand the Role of a Fiduciary

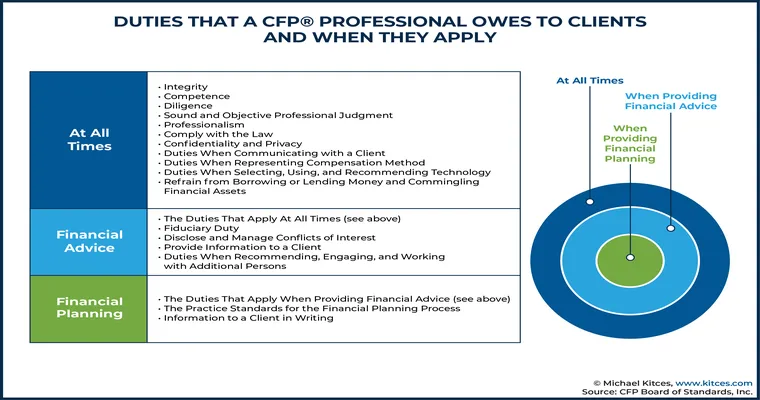

A fiduciary has a legal and ethical duty to act in the best interest of another person. This includes managing financial assets, paying bills, and making decisions regarding investments. In the case of a veteran, this may also involve understanding specific benefits and services available through the Department of Veterans Affairs (VA). Familiarizing yourself with these responsibilities is crucial before proceeding.

Determine the Need for a Fiduciary

Assess whether your friend truly needs a fiduciary. If your friend struggles with managing finances due to health issues, cognitive decline, or lack of understanding of financial matters, then becoming a fiduciary might be the right decision. Discuss your friend’s needs openly to ascertain if they feel comfortable with you taking on this role.

Legal Requirements to Become a Fiduciary

To become a fiduciary, you may need to go through a legal process. The requirements can vary by state, but generally, you will need to:

1. "File a petition" with the local court to be appointed as a fiduciary or guardian. This process often involves providing documentation of your friend’s situation.

2. "Obtain consent" from your friend if they are able to give it. If they are unable to understand the implications, the court may appoint you as a "guardian" instead.

3. "Undergo a background check" and possibly a hearing to ensure you are a suitable candidate for this position.

Gather Necessary Documentation

Compile all relevant documents that pertain to your friend’s financial affairs. This includes bank statements, bills, insurance policies, and any other financial records. Being organized will help you manage your friend’s finances more effectively once you are appointed.

Understand Financial Management

As a fiduciary, you are responsible for making sound financial decisions. This includes creating budgets, paying bills on time, managing investments, and ensuring that your friend’s benefits are maximized. You may benefit from taking a financial management course or seeking guidance from a financial advisor to ensure you are equipped to handle these responsibilities.

Familiarize Yourself with Veteran Benefits

Since your friend is a veteran, understanding the benefits available to them through the VA is crucial. This includes potential pensions, disability benefits, and healthcare options. Make sure to explore these resources and advocate for your friend to ensure they receive all the assistance they are entitled to.

Maintain Transparency and Communication

As you take on the role of fiduciary, maintaining open lines of communication with your friend is essential. Regularly discuss financial decisions and provide updates on their financial status. This transparency builds trust and ensures that you are acting in their best interest.

Seek Professional Help If Necessary

If you find the responsibilities overwhelming or if there are complex issues regarding your friend's financial situation, consider seeking professional assistance. Financial advisors, accountants, or attorneys can provide valuable insights and help you navigate challenging situations.

Conclusion

Becoming a fiduciary for a friend who is a veteran is a significant responsibility that can have a profound impact on their quality of life. By understanding the role, legal requirements, and financial management, you can ensure that you are prepared to support your friend effectively. Your dedication to helping them with their financial affairs will provide them with the peace of mind they deserve during a challenging time.