In the world of "financial management", "trusts", and "legal responsibilities", the term "fiduciary" often comes up, creating some confusion. While the word itself may seem straightforward, the implications and responsibilities associated with fiduciaries can vary significantly based on context. This article aims to clarify the differences between various types of fiduciaries and their roles in managing assets, ensuring compliance, and maintaining ethical standards.

Understanding Fiduciaries

A "fiduciary" is an individual or entity that has the legal and ethical obligation to act in the best interest of another party. This relationship is built on trust and confidence, making the fiduciary responsible for managing assets or making decisions that affect the well-being of the principal. Common examples of fiduciaries include "trustees", "guardians", and "financial advisors". Each type of fiduciary has specific duties and responsibilities that must be adhered to in order to maintain ethical standards and legal compliance.

Types of Fiduciaries

1. "Trustees": A trustee is often appointed to manage a trust, which is a legal arrangement where one party holds assets for the benefit of another. Trustees have a duty to act in the best interests of the beneficiaries, ensuring that the assets are managed wisely and distributed according to the terms of the trust.

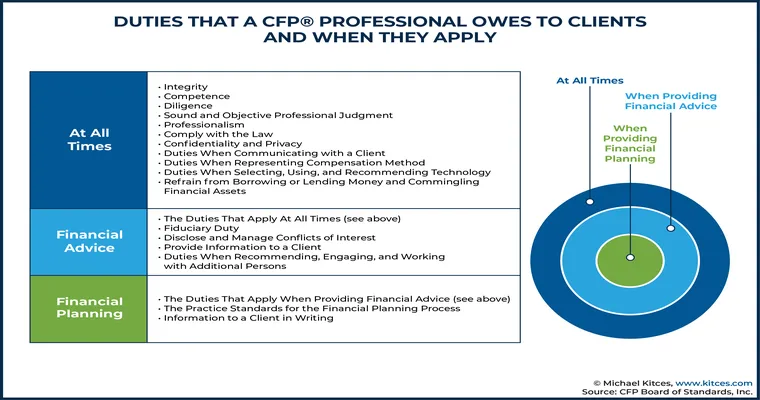

2. "Financial Advisors": These professionals provide financial guidance and services to clients. When operating as fiduciaries, financial advisors must prioritize their clients' interests above their own, avoiding conflicts of interest and disclosing any potential fees or commissions that could affect their recommendations.

3. "Guardians": In situations involving minors or incapacitated individuals, a guardian is appointed to make decisions on their behalf. This fiduciary role requires a deep understanding of the individual's needs and the ability to make choices that protect their well-being.

4. "Executors": An executor is responsible for managing the estate of a deceased person. This includes settling debts, distributing assets, and ensuring that the wishes of the deceased are honored. Executors must adhere to fiduciary duties to act fairly and transparently with beneficiaries.

The Importance of Fiduciary Duty

The concept of "fiduciary duty" is crucial in maintaining the integrity of relationships where trust is paramount. Fiduciaries are legally required to avoid self-dealing, conflicts of interest, and any actions that could harm the interests of those they serve. Breaching fiduciary duty can lead to legal consequences, including financial penalties and loss of professional licensure.

Choosing a Fiduciary

When selecting a fiduciary, it is essential to consider their qualifications, experience, and reputation. Individuals should seek fiduciaries who are transparent about their fees and services and who demonstrate a commitment to acting in the best interests of their clients or beneficiaries. Conducting due diligence can help ensure that the fiduciary relationship is built on trust and accountability.

Conclusion

Understanding the nuances of "fiduciaries" versus "fiduciaries" is essential for anyone involved in "financial planning", "estate management", or any situation requiring a trusted relationship. By recognizing the different roles and responsibilities, individuals can make informed decisions when selecting fiduciaries to manage their interests. Adhering to fiduciary duties not only protects the parties involved but also fosters a culture of trust and ethical responsibility in financial and legal matters.