Navigating the world of "Medicare" can be challenging, especially when it comes to understanding the options available for your loved ones. If you are considering whether to switch your parent from a "Medicare Advantage plan" to "Original Medicare" with a "Medigap supplement", it is essential to understand the implications and the process involved. This article will provide clarity on this transition and guide you through what you need to know.

Understanding Medicare Advantage and Original Medicare

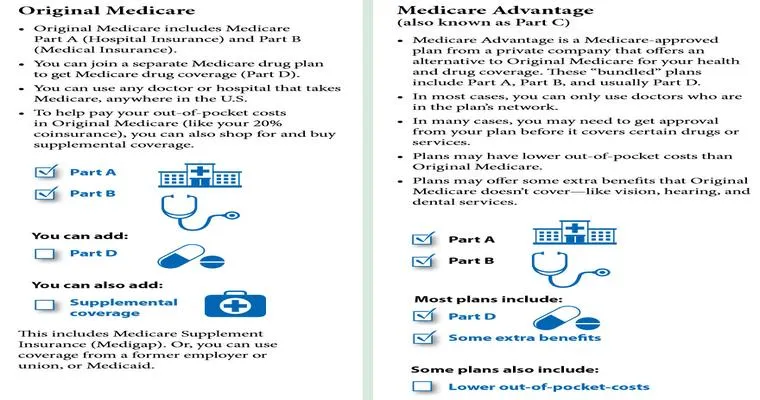

Medicare Advantage plans, also known as "Part C", are offered by private insurance companies and provide an alternative way to receive Medicare benefits. These plans often include additional services such as vision and dental coverage, but they may also have network restrictions and varying out-of-pocket costs.

On the other hand, "Original Medicare" consists of "Part A" (hospital insurance) and "Part B" (medical insurance). With Original Medicare, beneficiaries have the flexibility to choose any doctor or hospital that accepts Medicare, which can be beneficial for those who prefer more control over their healthcare options. Medigap, or Medicare Supplement Insurance, can then be added to help cover some of the out-of-pocket costs that Original Medicare does not cover.

The Process of Switching Plans

Switching from a Medicare Advantage plan to Original Medicare with a Medigap supplement is possible, but certain steps and considerations must be taken into account.

1. "Eligibility": First, ensure that your parent is eligible to switch. Generally, individuals can make changes during the "Annual Enrollment Period" (AEP), which runs from October 15 to December 7 each year. Additionally, there are other special enrollment periods that may apply depending on circumstances such as moving or losing other health coverage.

2. "Disenrollment from Medicare Advantage": To switch, your parent must officially disenroll from their current Medicare Advantage plan. This can usually be done through the insurance company or online, depending on the provider's processes. Ensure that this is completed before enrolling in Original Medicare.

3. "Enrolling in Original Medicare": Once the disenrollment is confirmed, your parent can enroll in Original Medicare. This can be done online through the Social Security Administration, by phone, or in person at a local Social Security office.

4. "Choosing a Medigap Plan": After enrolling in Original Medicare, your parent can apply for a Medigap plan to help cover additional costs. It is crucial to compare different Medigap plans, as they vary in coverage and costs. The best time to purchase a Medigap plan is during the "Medigap Open Enrollment Period", which begins the month your parent turns 65 and is enrolled in Medicare Part B. During this period, they have guaranteed issue rights, meaning they cannot be denied coverage based on health conditions.

Important Considerations

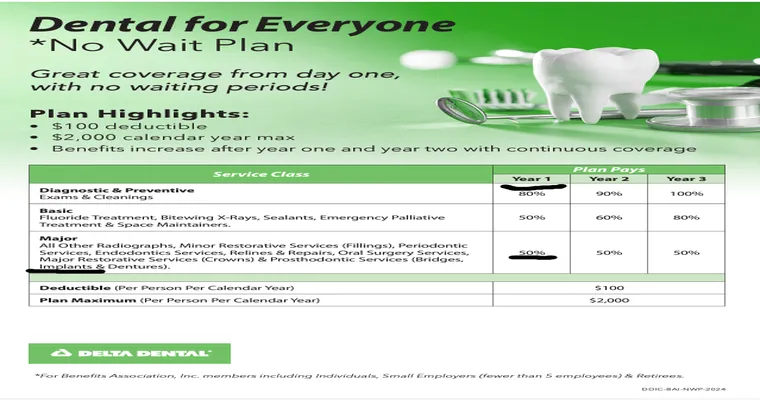

"Coverage Differences": Before making the switch, review the differences in coverage between the Medicare Advantage plan and Original Medicare. Consider factors such as premiums, deductibles, copayments, and coverage for specific services.

"Provider Networks": If your parent has a preferred doctor or hospital, check if they accept Original Medicare and if they participate in any Medigap plans you are considering.

"Costs": Understand the financial implications, including potential premium increases when switching to a Medigap plan. While Medigap can help with out-of-pocket costs, premiums can vary significantly.

Conclusion

In summary, switching your parent from a "Medicare Advantage plan" to "Original Medicare" with a "Medigap supplement" is feasible, provided you follow the necessary steps and consider the implications carefully. By understanding the differences between the plans and adequately preparing for the transition, you can help ensure your parent receives the best possible healthcare coverage tailored to their needs. Always consult with a licensed insurance agent or a Medicare expert to explore the options available and make informed decisions regarding your parent’s health care.