If you are navigating the complexities of healthcare coverage, particularly when it comes to "rehabilitation", understanding your benefits under "Blue Cross Blue Shield" and "Medicare Part A" is crucial. Many individuals and families seek clarity on how many days of rehab these plans cover, especially after a hospital stay or for recovery from surgery, injury, or illness. This article will provide essential information on the coverage specifics and the implications for your rehabilitation journey.

Understanding Medicare Part A Coverage for Rehab

"Medicare Part A" primarily covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health services. For rehabilitation services, the key aspect is the coverage of skilled nursing facilities (SNFs). To qualify for coverage, the patient must have a hospital stay of at least three consecutive days. This is crucial for ensuring that your rehab needs are met effectively.

Once you meet the criteria, "Medicare Part A" typically covers up to "100 days" of skilled nursing facility care per benefit period. The first 20 days are fully covered, while days 21 to 100 involve a coinsurance payment. This means that while you can receive extensive rehabilitation services, there are potential out-of-pocket costs to consider if your rehab extends beyond the initial 20 days.

The Role of Blue Cross Blue Shield in Rehab Coverage

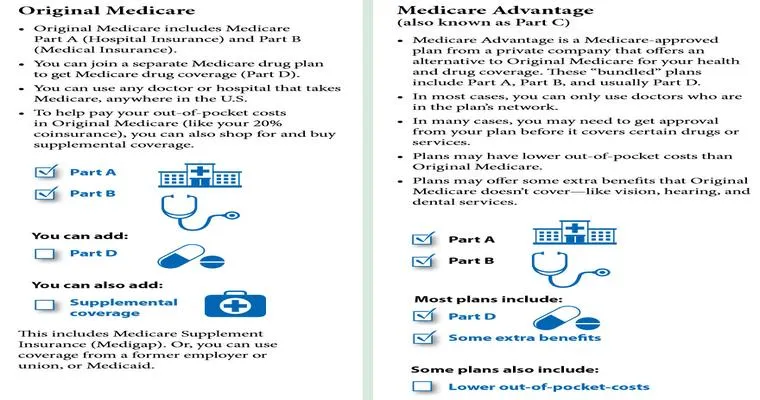

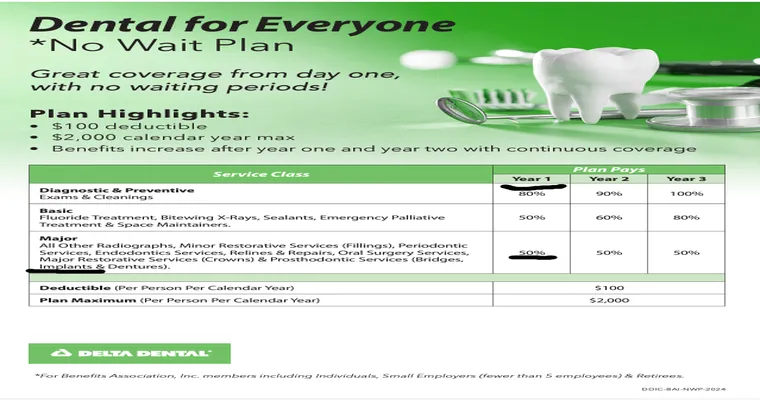

When you have "Blue Cross Blue Shield" in addition to "Medicare Part A", your coverage can be enhanced. Many Blue Cross Blue Shield plans offer supplemental benefits that may cover what Medicare does not, including additional days in a skilled nursing facility or outpatient rehab services. It is vital to review your specific plan details, as coverage can vary widely based on the type of Blue Cross Blue Shield plan you have—whether it is a Medicare Advantage plan, a Medigap policy, or a standard health insurance plan.

Coordinating Benefits for Maximum Coverage

To ensure that you maximize your rehab coverage, it is advisable to coordinate between "Medicare Part A" and your "Blue Cross Blue Shield" plan. Here are a few steps to consider:

1. "Verify Eligibility": Confirm that you meet the eligibility requirements for "Medicare Part A" coverage for rehab services.

2. "Understand Your Plan": Review your Blue Cross Blue Shield plan documents to identify any additional coverage or benefits for rehab services.

3. "Consult Your Healthcare Provider": Speak with your healthcare provider about your rehab needs and how best to utilize both Medicare and your Blue Cross Blue Shield plan.

4. "Contact Customer Service": Reach out to customer service for both Medicare and Blue Cross Blue Shield for clarification on coverage details and any necessary pre-authorization processes.

Conclusion

Navigating rehabilitation coverage under "Blue Cross Blue Shield" and "Medicare Part A" can be complex, but understanding the details is essential for receiving the care you need. With Medicare Part A covering up to 100 days of skilled nursing care and the potential for enhanced coverage through Blue Cross Blue Shield, you can ensure that your recovery is well-supported. Always remember to check your specific plan details and consult with healthcare professionals to make informed decisions about your rehabilitation journey.