Navigating the complexities of "New York State Medicaid" can be challenging, especially when it comes to understanding the implications of selling a home. Many individuals wonder if a "spouse can sell a home" when their partner is receiving Medicaid benefits. This article will explore the legalities, potential consequences, and options available for couples in this situation.

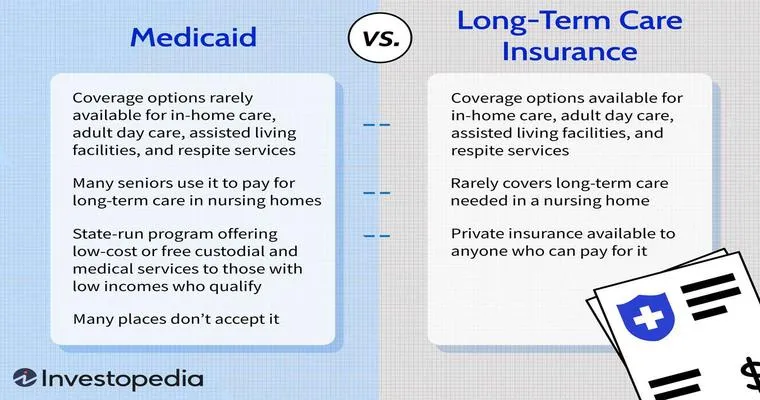

In New York, Medicaid is designed to assist individuals with limited income and resources in covering healthcare costs. When one spouse is enrolled in Medicaid, the couple’s financial situation can become more complicated, particularly regarding home ownership. It is essential to understand how the sale of a home might affect Medicaid eligibility and benefits.

When considering whether a "spouse can sell a home", it is crucial to recognize that the home is often considered an exempt asset for Medicaid purposes. In many cases, if one spouse is receiving Medicaid, the home may not count against the asset limit, allowing the spouse living in the home to maintain ownership without jeopardizing benefits. However, the rules surrounding asset limits can vary, and it is important to consider the following factors:

1. "Equity in the Home": Medicaid has specific guidelines regarding how much equity in a home is permissible. If the equity exceeds the allowable limit, it could impact eligibility for Medicaid.

2. "Intent of the Sale": If the home is sold with the intent to qualify for Medicaid or to create funds that would disqualify the spouse from receiving benefits, this could lead to complications. Medicaid has rules against "asset transfer" that may penalize individuals who attempt to manipulate their financial situation to qualify for benefits.

3. "Spousal Impoverishment Protections": New York State has provisions in place to protect the spouse who is not on Medicaid from becoming impoverished due to their partner's healthcare costs. This includes the ability to retain a certain amount of assets, including the home.

4. "Reinvestment of Proceeds": If the home is sold, the proceeds can potentially impact Medicaid eligibility. It is essential to understand how these funds will be used and whether they will be considered when determining eligibility for ongoing Medicaid benefits.

5. "Consulting a Legal Expert": Given the intricacies involved, it is advisable to consult with an attorney who specializes in elder law or Medicaid planning. They can provide guidance tailored to the specific circumstances of the couple.

In conclusion, while a "spouse can sell a home" when their partner is on Medicaid, doing so requires careful consideration of Medicaid rules and potential consequences. Understanding the implications of selling the home and how it may affect Medicaid eligibility is crucial for protecting both spouses' financial well-being. If you find yourself in this situation, make sure to seek professional advice to navigate the complexities of Medicaid and home ownership effectively.