Caring for aging parents can be a fulfilling yet challenging responsibility, especially when it comes to "financial planning". As a caregiver, it's essential to navigate the complexities of "healthcare costs", "retirement savings", and "estate planning". Implementing effective "financial strategies" can help ease the burden on both caregivers and their parents while ensuring that everyone is prepared for the future.

Understand the Financial Needs of Your Parents

The first step in effective "financial planning" is to assess the specific needs of your aging parents. This includes understanding their current financial situation, outstanding debts, monthly expenses, and potential future costs such as long-term care or assisted living facilities. Gathering this information allows you to create a comprehensive budget that reflects their financial landscape.

Create a Realistic Budget

Once you have a clear picture of your parents' financial needs, the next step is to develop a budget. This budget should encompass all their living expenses, including housing, utilities, groceries, healthcare, and any other recurring costs. Be sure to factor in potential emergencies and unexpected expenses as well. As a caregiver, you may need to contribute financially; therefore, it is crucial to create a budget that accounts for your own financial obligations as well.

Explore Available Resources

There are numerous resources available to support caregivers and their parents. Investigate local and state programs that offer financial assistance, such as Medicaid or veterans' benefits. Additionally, non-profit organizations may provide financial counseling or educational resources aimed at helping families navigate the complexities of caregiving and financial management.

Plan for Healthcare Costs

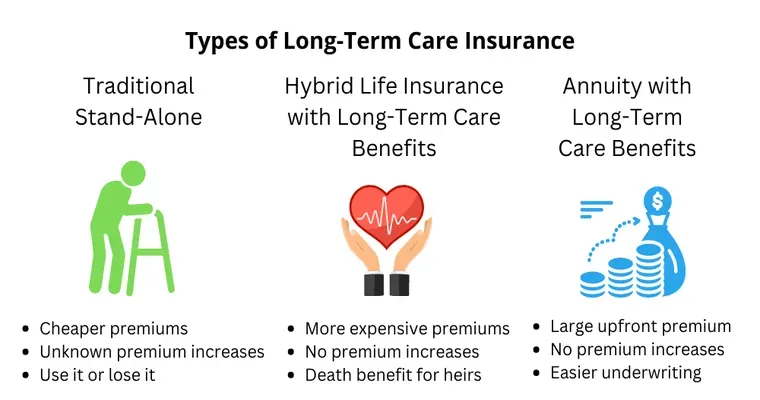

Healthcare costs can be one of the most significant expenses for aging parents. It is essential to review their insurance policies, including Medicare and any supplemental insurance they may have. Understanding what is covered and any potential out-of-pocket costs will help you prepare for future expenses. Consider exploring long-term care insurance options as well, which can alleviate some of the financial burdens associated with in-home care or nursing facilities.

Encourage Retirement Planning

If your parents are still in the workforce, encourage them to maximize their retirement savings. This can include contributing to 401(k) plans or individual retirement accounts (IRAs). If they are already retired, review their existing retirement funds and discuss strategies to ensure their savings last throughout their retirement. A financial advisor can provide valuable insights tailored to their specific situation.

Discuss Estate Planning

Estate planning is a crucial aspect of "financial planning" that is often overlooked. Discuss the importance of wills, trusts, and powers of attorney with your parents. These legal documents can help ensure that their wishes are honored and can simplify the process for you and your family in the event of incapacity or death. It’s advisable to consult with an estate planning attorney to draft and finalize these documents appropriately.

Communicate Openly and Regularly

Open communication is vital when it comes to financial planning. Regular discussions about finances can help prevent misunderstandings and ensure everyone is on the same page. Encourage your parents to share their thoughts and concerns regarding their financial future, and be willing to provide your own input as a caregiver. This dialogue can strengthen your relationship and make the financial planning process more manageable.

Stay Informed and Seek Professional Advice

Financial planning is an ongoing process, and it's essential to stay informed about any changes in laws or resources that may affect your parents' financial situation. Consider seeking guidance from financial advisors who specialize in elder care or family finances. These professionals can provide personalized strategies that align with your family's unique needs.

In conclusion, effective "financial planning" for caregivers and their parents requires a proactive approach. By understanding financial needs, creating budgets, exploring resources, planning for healthcare costs, encouraging retirement savings, discussing estate planning, maintaining open communication, and seeking professional advice, caregivers can navigate the complexities of caring for aging parents more confidently. Taking these steps can lead to a more secure financial future for both caregivers and their loved ones.