Finding a "fiduciary" is an important step for anyone looking to manage their financial future with confidence. A fiduciary is a professional who is legally required to act in your best interest when it comes to financial matters. This can include investment advisors, estate planners, and financial planners. If you’re asking yourself, "How do I find a fiduciary?" you’re not alone. Here are some effective strategies to help you locate a qualified fiduciary who can guide you through your financial journey.

The first step in your search for a fiduciary is to "understand the different types" of fiduciaries available. Financial advisors, accountants, and attorneys can all operate as fiduciaries, but their areas of expertise may vary significantly. Knowing what specific services you require can help narrow down your options. For example, if you need help with retirement planning, look for a fiduciary with a strong background in that specific area.

Next, you'll want to "conduct thorough research". Start by asking for recommendations from friends, family, or colleagues who have had positive experiences with fiduciaries in the past. Online platforms, such as financial advisor directories or professional organizations like the National Association of Personal Financial Advisors (NAPFA), can also provide valuable lists of fiduciaries in your area.

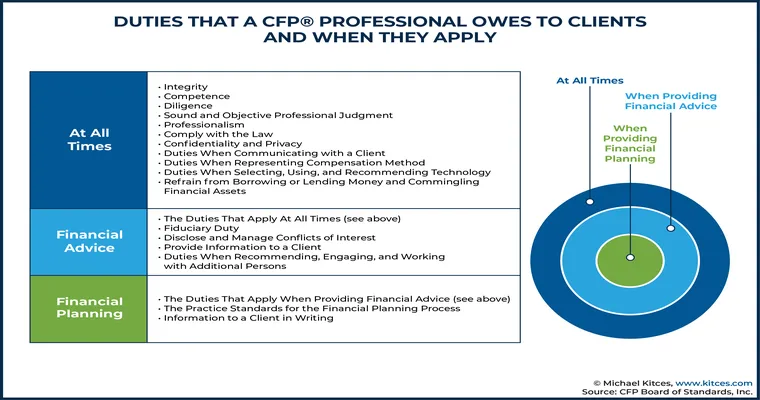

Once you have a list of potential fiduciaries, the next step is to "check their credentials". Verify that they hold recognized certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). These credentials indicate a higher level of expertise and commitment to ethical standards. It’s also important to check for any disciplinary history or complaints against them through regulatory bodies like the Financial Industry Regulatory Authority (FINRA) or the Securities and Exchange Commission (SEC).

After verifying credentials, it’s time to "schedule initial consultations". Many fiduciaries offer free introductory meetings, which can help you gauge whether they would be a good fit for your financial needs. During these meetings, ask about their investment philosophy, fee structure, and how they plan to communicate with you. This is also a great opportunity to assess their responsiveness and willingness to answer your questions.

When considering a fiduciary, it’s essential to "discuss fees upfront". Fiduciaries can charge through various models such as hourly rates, flat fees, or a percentage of assets under management. Understanding how they charge will help you make an informed decision and avoid any surprises down the line. Always clarify what services are included in their fee structure.

Lastly, trust your instincts. The relationship between you and your fiduciary should be built on "trust and transparency". If something doesn’t feel right or if you feel pressured during the decision-making process, it’s okay to continue your search. Finding a fiduciary who not only meets your qualifications but also aligns with your personal values and communication style is crucial for a successful partnership.

In summary, finding a fiduciary involves understanding the types available, conducting thorough research, checking credentials, scheduling consultations, discussing fees, and trusting your instincts. By following these steps, you can ensure that you find a fiduciary who will act in your best interest and help you achieve your financial goals.