In today's world, planning for the future is essential, especially when it comes to healthcare needs. One critical aspect of this planning is "long term care insurance". This type of insurance is designed to cover services that assist individuals with activities of daily living, such as bathing, dressing, and eating, which may be necessary due to age, illness, or disability. As life expectancy increases, the importance of understanding "long term care" options becomes even more significant.

What is Long Term Care Insurance?

"Long term care insurance" is a policy that helps cover the costs associated with long-term care services. These services can be provided in various settings, including nursing homes, assisted living facilities, or even at home. Unlike traditional health insurance, which often covers only short-term medical care, long term care insurance focuses on helping individuals who need ongoing assistance.

Why Do You Need Long Term Care Insurance?

Many people underestimate the likelihood of needing long-term care. According to statistics, nearly 70 percent of individuals over the age of 65 will require some form of long-term care during their lifetime. Without "long term care insurance", the financial burden of these services can deplete savings and impact family members. Having a policy in place can provide peace of mind and financial security, allowing individuals to receive the necessary care without the stress of significant out-of-pocket expenses.

How Does Long Term Care Insurance Work?

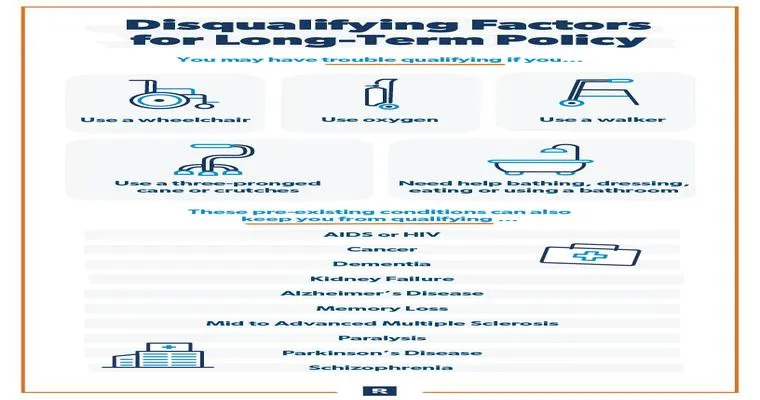

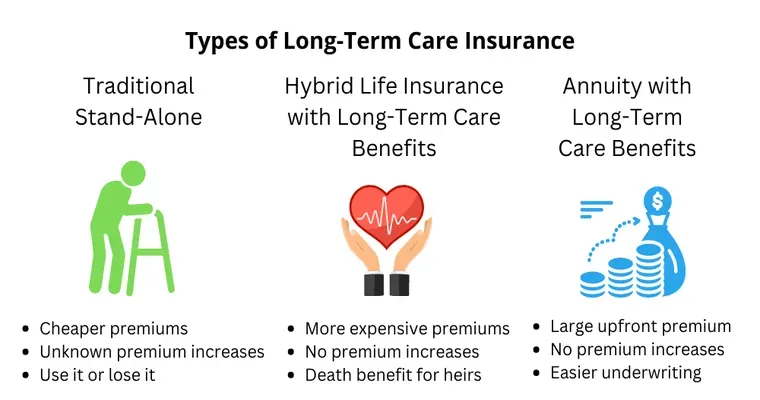

When you purchase a "long term care insurance" policy, you typically pay monthly premiums. In return, the insurance company agrees to cover certain costs for long-term care services once you meet the qualifying criteria. Policies can vary widely in terms of coverage options, benefit amounts, and waiting periods. It is essential to carefully review different plans and choose one that aligns with your specific needs and budget.

Factors to Consider When Choosing a Policy

1. "Coverage Options": Ensure the policy covers the types of care you may need, such as in-home care, nursing home care, and assisted living.

2. "Benefit Amount": Assess how much coverage you need. Consider the average cost of care in your area and how much you can afford to pay out-of-pocket.

3. "Elimination Period": This is the waiting period before benefits kick in. Policies with longer elimination periods typically have lower premiums.

4. "Inflation Protection": Look for policies that offer inflation protection to ensure your benefits keep pace with rising costs of care.

When Should You Purchase Long Term Care Insurance?

The ideal time to purchase "long term care insurance" is when you are younger and healthier. Premiums are generally lower for those who are in good health and can qualify for better rates. Waiting until you are older or have health issues can limit your options and increase costs. It is advisable to start researching and planning for long-term care in your 50s or early 60s.

Conclusion

Investing in "long term care insurance" is a crucial step in planning for your future healthcare needs. By understanding the various aspects of long-term care, including its necessity, how it works, and what to consider when choosing a policy, you can make informed decisions that protect your financial well-being. As healthcare continues to evolve, being proactive about long-term care planning will ensure that you and your loved ones are prepared for whatever the future may hold.