In recent years, "long-term care insurance rates" have seen a significant increase, particularly affecting "women". This trend can be attributed to various factors, including longer life expectancy, higher healthcare costs, and changing demographics. Understanding these rising costs is crucial for women who are planning for their future healthcare needs.

As women typically live longer than men, they face a greater risk of requiring long-term care. According to statistics, women spend an average of 3.7 years in long-term care facilities, compared to 2.2 years for men. This reality not only emphasizes the importance of long-term care planning but also contributes to the higher premiums associated with long-term care insurance for women. Insurers assess the likelihood of claims based on these averages, leading to an increase in rates for women seeking coverage.

Another contributing factor to rising "long-term care insurance rates" for women is the increasing cost of healthcare. The expenses associated with long-term care services, including nursing homes, assisted living facilities, and home health aides, have escalated over the years. As these costs rise, so do the premiums for long-term care insurance. Women, who often have a greater need for such services due to their longer lifespans, are particularly affected by this trend.

Furthermore, demographic shifts are impacting the long-term care insurance landscape. With an aging population, the demand for long-term care services is on the rise. This growing need can lead to increased competition among insurance providers, which may drive up rates. Women, who are more likely to require these services, may face even steeper increases in their insurance premiums.

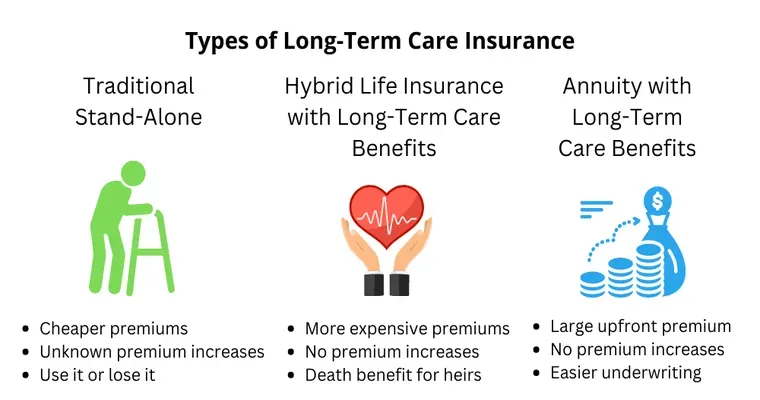

Planning for long-term care is essential, especially for women. It is important to start considering coverage options early, as the cost of long-term care insurance is generally lower when purchased at a younger age. Additionally, exploring various policies and comparing quotes can help women find the best coverage at a more affordable rate.

In conclusion, the rise in "long-term care insurance rates for women" is influenced by several factors, including longer life expectancy, increasing healthcare costs, and demographic changes. Women must take proactive steps to plan for their long-term care needs, ensuring they have the necessary coverage to protect their financial future. By staying informed and exploring their options, women can navigate these rising costs more effectively.