When it comes to financing long-term care in a nursing home, many families find themselves asking, "Will "Medicaid" or "Medicare" cover the costs?" Understanding the differences between these two government programs is essential for determining who will ultimately pay for nursing home fees. In this article, we will explore the criteria for both Medicaid and Medicare, their coverage options, and what you need to know to make informed decisions about long-term care financing.

Understanding Medicare

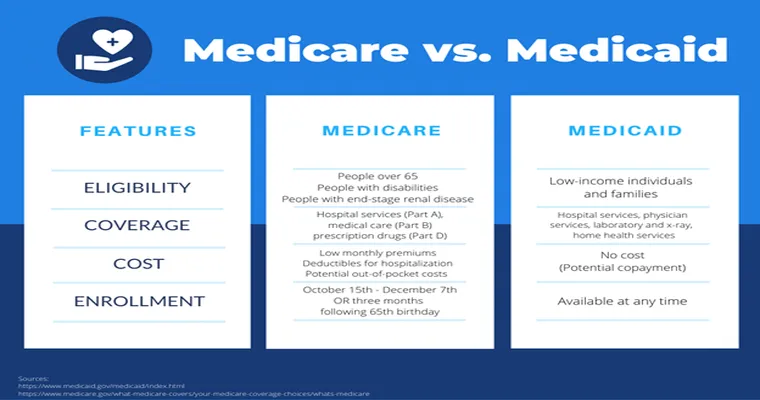

"Medicare" is a federal health insurance program primarily designed for individuals aged 65 and older, as well as certain younger individuals with disabilities. It consists of several parts, with "Part A" covering hospital stays, skilled nursing facility (SNF) care, hospice care, and some home health care. However, it is important to note that Medicare only covers nursing home costs under specific conditions.

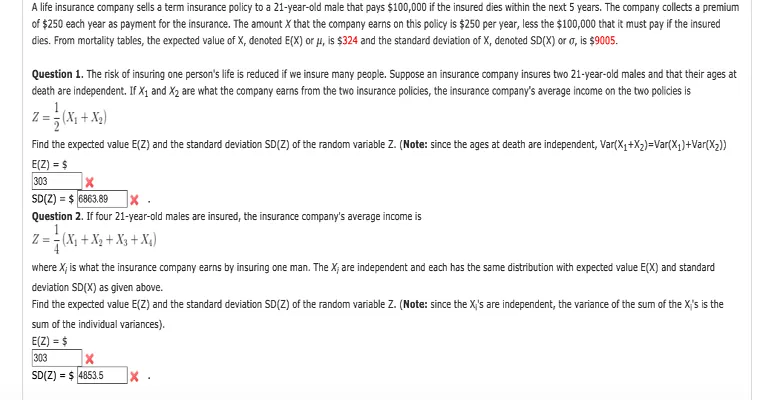

To qualify for Medicare coverage in a nursing home, patients must have been hospitalized for at least three consecutive days and must require skilled nursing care or rehabilitation services. Under these conditions, Medicare will cover up to 100 days in a skilled nursing facility, but this coverage typically comes with some out-of-pocket costs. After the first 20 days, beneficiaries are responsible for a daily coinsurance amount.

Understanding Medicaid

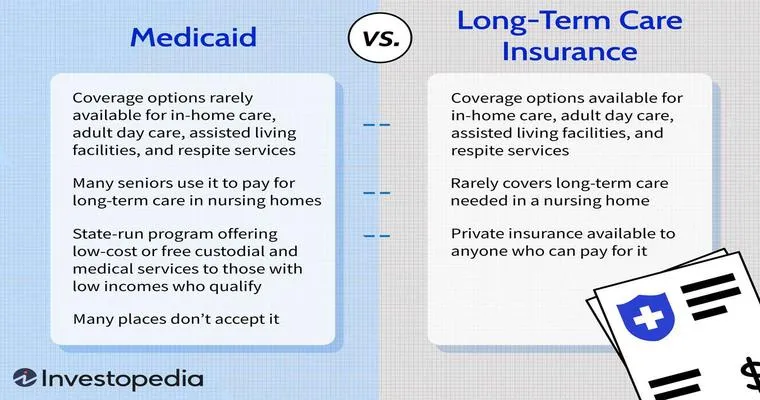

"Medicaid", on the other hand, is a state and federal program that provides health coverage to individuals with limited income and resources. Unlike Medicare, Medicaid offers more comprehensive support for long-term care, including nursing home fees. It is particularly beneficial for those who have exhausted their personal savings and require assistance to afford the high costs associated with long-term care.

To qualify for Medicaid, applicants must meet specific income and asset thresholds, which vary by state. Most states have a program called "Medicaid Waiver", which allows individuals to receive care in a nursing home or through homeand community-based services (HCBS) without having to deplete their savings entirely.

Key Differences Between Medicaid and Medicare

The primary differences between Medicaid and Medicare regarding nursing home coverage include:

1. "Eligibility": Medicare mainly serves seniors and those with disabilities, while Medicaid caters to low-income individuals and families.

2. "Coverage Duration": Medicare provides limited coverage (up to 100 days) for skilled nursing care, while Medicaid can cover long-term stays in nursing homes as long as eligibility requirements are met.

3. "Cost Sharing": Medicare requires beneficiaries to pay deductibles and coinsurance for nursing home care, while Medicaid often covers the entire cost for eligible individuals.

What to Consider When Planning for Nursing Home Care

When considering nursing home care, it is crucial to evaluate your financial situation and understand how both "Medicaid" and "Medicare" fit into your long-term care plans. Here are some steps to help you navigate the process:

1. "Assess Your Needs": Determine the level of care required and whether it falls under Medicare or Medicaid's coverage.

2. "Review Eligibility": Check the eligibility criteria for both programs based on income and assets.

3. "Consult with Professionals": Speak with a financial advisor or elder law attorney to explore options for financing long-term care and protecting your assets.

4. "Plan Ahead": Early planning can help you avoid financial strain when the need for nursing home care arises.

Conclusion

In summary, understanding who pays for nursing home fees through "Medicaid" or "Medicare" is crucial for effective planning. While Medicare provides limited coverage for short-term stays, Medicaid can offer more extensive support for those who qualify. By being informed about both programs, you can make better decisions regarding long-term care and ensure that you or your loved ones receive the necessary support without facing overwhelming financial burdens.