Medicaid planning is a crucial aspect of financial preparation for individuals and families who may need assistance with long-term care costs. As healthcare expenses continue to rise, understanding the intricacies of "Medicaid eligibility", "asset protection", and "long-term care" options becomes essential. This article will explore the various strategies involved in Medicaid planning, helping you navigate the complexities of the system while safeguarding your assets.

What is Medicaid?

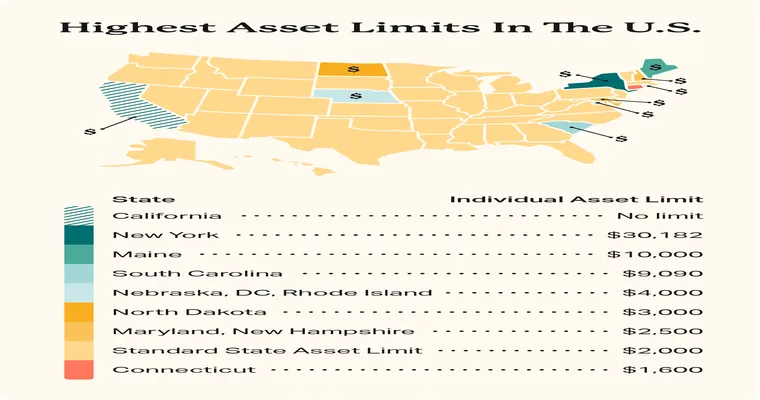

Medicaid is a government program that provides health coverage to low-income individuals and families. It is jointly funded by the federal and state governments and is designed to assist those who cannot afford medical care. Medicaid covers a range of services, including hospital stays, doctor visits, and long-term care in nursing facilities. However, to qualify for Medicaid, applicants must meet specific "income" and "asset" requirements, which can vary by state.

The Importance of Medicaid Planning

"Medicaid planning" is essential for individuals who anticipate needing long-term care, especially as they age. Without proper planning, the costs associated with nursing homes and assisted living facilities can quickly deplete an individual's savings, leaving them with little to no financial resources. By engaging in effective Medicaid planning, individuals can protect their assets while ensuring they receive the necessary medical care.

Key Strategies for Medicaid Planning

1. "Asset Protection": One of the primary goals of Medicaid planning is to protect assets from being depleted by long-term care costs. This can involve transferring ownership of assets to family members or establishing trusts that qualify for Medicaid exemptions.

2. "Spend-Down Strategies": If an individual’s income or assets exceed Medicaid limits, they may need to spend down their resources to qualify. This can include paying off debts, purchasing medical equipment, or making necessary home improvements.

3. "Gifting and Trusts": Strategically gifting assets to loved ones or setting up irrevocable trusts can help in qualifying for Medicaid. However, it is crucial to understand the five-year look-back rule, which can penalize applicants for gifts made within five years of applying for Medicaid.

4. "Consulting Professionals": Working with an elder law attorney or a financial planner experienced in Medicaid planning can provide valuable insights and personalized strategies. These professionals can help navigate the complexities of the Medicaid application process and develop a tailored plan.

Common Misconceptions about Medicaid Planning

Many people mistakenly believe that Medicaid is only for the very poor. While it does assist low-income individuals, it also provides support for those who may have modest assets but require long-term care. Additionally, some individuals think that they cannot qualify for Medicaid if they own a home. In reality, many states offer exemptions for primary residences, allowing individuals to retain their homes while still qualifying for benefits.

Conclusion

Medicaid planning is an essential step in preparing for future healthcare needs. By understanding the various strategies available, individuals can ensure that they receive the necessary care without jeopardizing their financial stability. Whether you are planning for yourself or a loved one, taking the time to develop a comprehensive Medicaid plan can provide peace of mind and protect your assets for the future. Remember, consulting with professionals who specialize in "Medicaid eligibility" and "long-term care" can significantly enhance your planning efforts.