Navigating "Medicaid" and its regulations can be complex, especially when it comes to managing personal assets like a "vehicle". For individuals already accepted into the program, the question often arises: Can they sell their personal vehicle to help cover their expenses without jeopardizing their benefits? Understanding the implications of selling a vehicle while on Medicaid is crucial for ensuring financial stability while maintaining eligibility for necessary services.

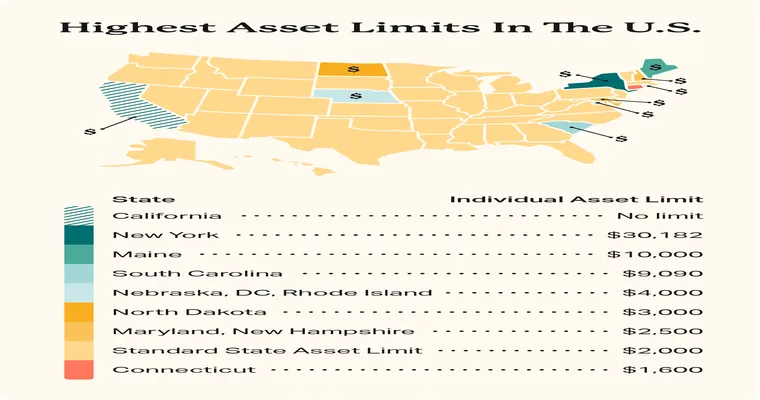

When a person is enrolled in Medicaid, they are subject to specific asset limits that determine their eligibility for assistance. Generally, Medicaid allows individuals to keep certain assets, including a primary vehicle, as long as its value falls below a specific threshold. In many states, the value of the vehicle is not counted towards the asset limit, provided it is used for essential transportation needs.

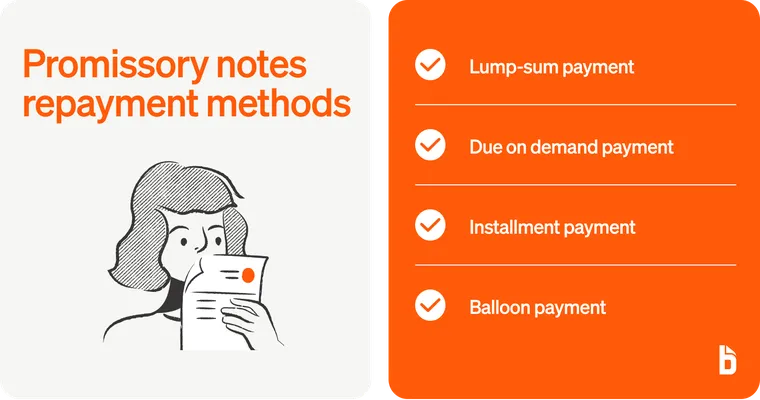

However, if a person decides to sell their personal vehicle, it can have significant implications for their Medicaid benefits. The proceeds from the sale are considered income, which could push the individual over the allowable income limit for Medicaid eligibility. Therefore, it is essential to carefully strategize and consider the potential consequences before proceeding with the sale.

If the vehicle is sold for a fair market value, the income generated may need to be reported to the Medicaid program. Failing to report this change can result in penalties or loss of benefits, which can be detrimental for anyone relying on Medicaid for essential healthcare services. It is crucial for individuals to consult with a Medicaid expert or a financial advisor to understand the specific rules and regulations in their state regarding asset sales.

Moreover, individuals should also consider alternative uses for their vehicle before deciding to sell. If the vehicle is no longer necessary for transportation, they might explore options like donating it to a charitable organization, which could provide a tax deduction without impacting Medicaid eligibility.

In conclusion, while it is possible for a person on Medicaid to sell their personal vehicle, doing so requires careful consideration of the implications on their "Medicaid benefits". Ensuring compliance with Medicaid regulations is essential to avoid unexpected financial challenges. Consulting with professionals who specialize in Medicaid can provide valuable insight and help individuals make informed decisions regarding asset management while maintaining their eligibility for necessary assistance.