Long-Term Care (LTC) coverage is an essential safeguard for families facing the challenges of aging and health-related issues. However, it is crucial to understand that "LTC insurance" does not last forever. Once the coverage runs out, the remaining spouse may find themselves in a precarious financial situation. Protecting "assets" after LTC coverage has been exhausted is critical to ensuring financial stability and security for the surviving partner. This article explores strategies that can help the remaining spouse safeguard their assets once LTC runs out.

Understand the Limitations of LTC Coverage

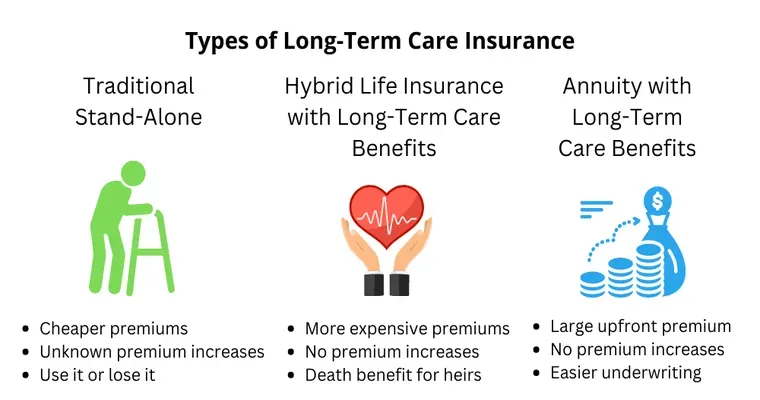

LTC insurance typically covers a specific duration of care, which may vary based on the policy. It's vital to be aware of the limitations of your coverage, including daily benefit amounts, total benefit limits, and the duration of care provided. This understanding will help you plan more effectively for the future.

Consider Asset Protection Strategies

Once LTC coverage is about to run out, the remaining spouse should consider various "asset protection strategies". This involves legally structuring assets to minimize exposure to potential long-term care costs in the future. Here are a few common approaches:

1. "Irrevocable Trusts": Establishing an irrevocable trust can help protect assets from being counted as available resources for Medicaid eligibility. By transferring ownership of assets into the trust, the remaining spouse can potentially shield those assets from claims.

2. "Gifting Assets": Another strategy is to gift assets to children or other family members. However, it is essential to understand the implications of the "look-back period" for Medicaid eligibility, as gifts made within five years of applying for Medicaid may affect eligibility.

3. "Medicaid Planning": Working with a financial advisor or elder law attorney to develop a comprehensive "Medicaid plan" can assist in protecting assets while ensuring the remaining spouse qualifies for necessary benefits.

Evaluate the Current Financial Situation

Assessing the financial situation post-LTC coverage is critical. The remaining spouse should take stock of their income, expenses, and remaining assets. This evaluation will help determine the best course of action for protecting assets and ensuring a sustainable income.

Explore Alternative Care Options

Once LTC coverage is no longer available, exploring alternative care options can also be beneficial. In-home care, adult day care, or community resources may offer less expensive alternatives to extended facility care. This can help preserve assets while still providing necessary care.

Stay Informed About Benefits and Resources

It is essential for the remaining spouse to stay informed about available benefits and resources. Many states offer programs that provide financial assistance or services for seniors. Researching these options can help in finding additional support and protecting assets.

Seek Professional Guidance

Navigating the complexities of LTC coverage and asset protection can be overwhelming. Seeking guidance from professionals, such as financial planners, estate attorneys, or elder law specialists, can provide valuable insights and tailored strategies to protect assets effectively.

Conclusion

While LTC coverage is a critical component of financial planning for long-term care needs, it is essential to recognize that it does not last forever. By understanding the limitations of LTC insurance and implementing effective "asset protection strategies", the remaining spouse can safeguard their financial future. Staying informed, evaluating the current situation, and seeking professional assistance are key steps in ensuring that assets are protected once LTC coverage runs out.