When it comes to "Medicaid planning", understanding the role of "trusts" can be crucial for protecting your assets and ensuring eligibility for benefits. Many individuals and families face the challenge of navigating the complexities of Medicaid while trying to preserve their wealth for future generations. Here are four key things to know about trusts and Medicaid planning that can help you make informed decisions.

1. The Purpose of Trusts in Medicaid Planning

Trusts serve as powerful tools in "Medicaid planning" by allowing individuals to manage and protect their assets. A trust can hold various types of property, such as real estate, bank accounts, and investments, while specifying how these assets should be distributed. By placing assets in a trust, you can potentially avoid the Medicaid look-back period, which typically spans five years. This can help ensure that your assets remain intact while you qualify for Medicaid benefits.

2. Types of Trusts

There are several types of trusts that can be used for "Medicaid planning" purposes. The most common include:

"Revocable Trusts": These allow you to retain control over your assets while providing flexibility. However, since you can modify or dissolve the trust at any time, the assets are still considered part of your estate for Medicaid eligibility.

"Irrevocable Trusts": Once established, these trusts cannot be changed or revoked without the consent of the beneficiaries. Assets placed in irrevocable trusts are generally not counted when determining Medicaid eligibility, making them a popular choice for asset protection.

"Special Needs Trusts": If you have a disabled beneficiary, a special needs trust can provide for their financial needs without jeopardizing their eligibility for government assistance programs, including Medicaid.

3. The Look-Back Period

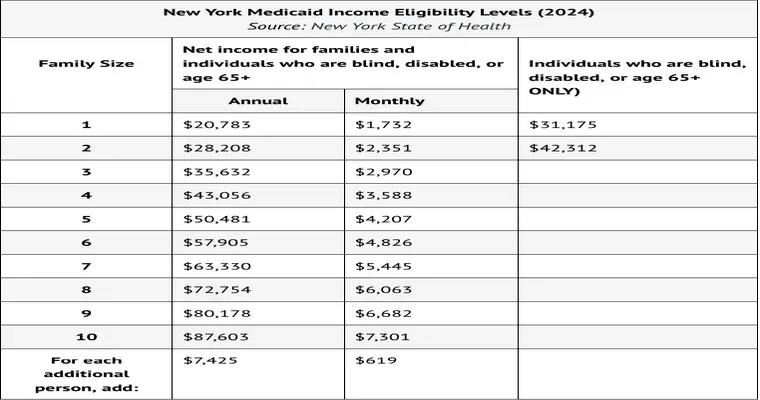

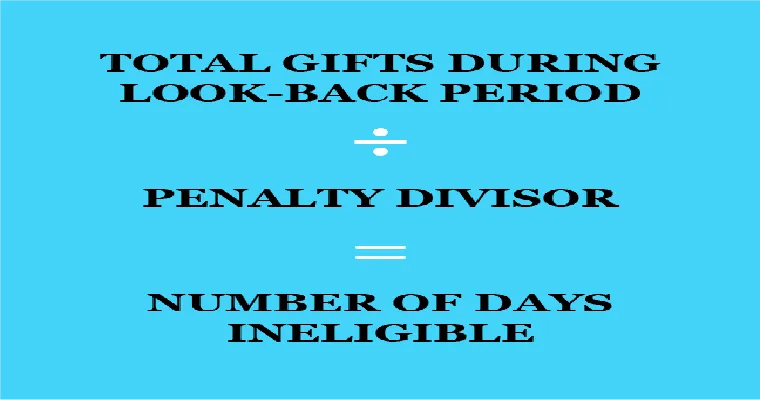

One of the most critical aspects of "Medicaid planning" is the look-back period, which is usually five years. During this time, Medicaid reviews your financial transactions to ensure you have not transferred assets to qualify for benefits. If any asset transfers occur within this period, it could result in a penalty period during which you will be ineligible for Medicaid. Establishing a trust well in advance of applying for Medicaid can help you manage these concerns and possibly avoid penalties.

4. Choosing the Right Legal Assistance

Navigating the complexities of "trusts" and "Medicaid planning" can be challenging. It is essential to seek professional guidance from an attorney who specializes in elder law or estate planning. A knowledgeable attorney can help you understand which type of trust is most suitable for your situation, ensure compliance with Medicaid regulations, and assist with the necessary documentation. Proper legal assistance can save you time and prevent costly mistakes in the long run.

In conclusion, understanding the relationship between "trusts" and "Medicaid planning" is vital for asset protection and securing benefits. By considering the types of trusts available, the implications of the look-back period, and seeking professional advice, you can create a strategic plan that safeguards your wealth while ensuring eligibility for Medicaid.