Understanding when a "primary residence" is exempt from "Medicaid" can be crucial for individuals planning for long-term care and financial security. Medicaid is a government health insurance program designed to assist low-income individuals with medical expenses, including nursing home care. However, it has specific asset limitations, and knowing how your home fits into these rules can help protect your assets. In this article, we will explore the conditions under which a primary residence may be exempt from Medicaid eligibility.

What is Medicaid?

Medicaid is a state and federal program that provides healthcare coverage for individuals with limited income and resources. Each state has its own rules regarding eligibility and coverage, but generally, Medicaid helps pay for nursing home care, in-home health services, and other medical expenses.

Primary Residence and Medicaid Eligibility

One of the key considerations when applying for Medicaid is the consideration of assets. A "primary residence" is often one of the largest assets an individual owns, and determining its status can significantly impact Medicaid eligibility.

Exemptions for Primary Residence

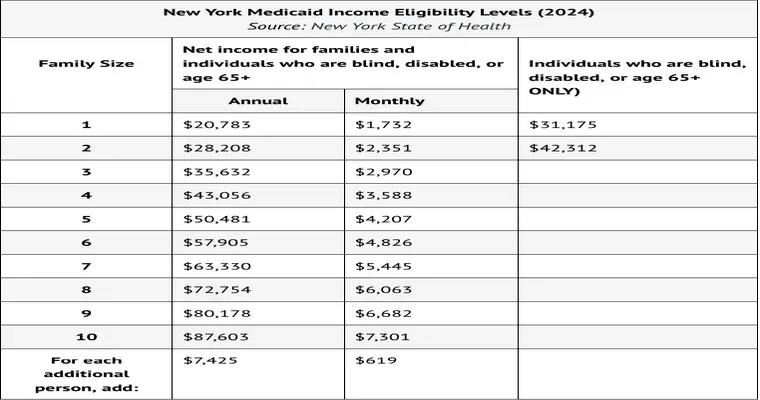

1. "Home Equity Limits": In many states, Medicaid allows for a "home equity exemption" up to a certain limit. This means that if the equity in your home is below this threshold, your primary residence will be exempt from Medicaid’s asset calculation. As of 2023, this limit varies by state, so it is essential to check your local regulations.

2. "Spousal Exemptions": If an individual requires long-term care in a nursing home but has a spouse living in the community, the home is usually considered exempt. Medicaid recognizes the need for the community spouse to have a place to live, thereby protecting the primary residence.

3. "Intent to Return Home": If the individual is temporarily residing in a nursing facility but intends to return home, their primary residence may remain exempt. This is particularly relevant for those who have not permanently abandoned their home.

4. "Disabled or Minor Children": If the primary residence is occupied by a "disabled" or "minor child", it may be exempt from Medicaid consideration. This provision helps in protecting the home for those who may need it for their care or support.

5. "Life Estate": If an individual has created a "life estate" in their home, where they retain the right to live there for the rest of their life, this can also exempt the property from Medicaid eligibility calculations.

Conclusion

Understanding the nuances of Medicaid exemptions regarding a "primary residence" is essential for individuals planning for their future healthcare needs. By knowing the circumstances under which your home may be exempt, you can make informed decisions that protect your assets while ensuring access to necessary medical care. If you or a loved one are navigating Medicaid eligibility, it is advisable to consult with a financial advisor or an attorney specializing in elder law to ensure that you fully understand your options and rights.