Navigating the complexities of "Medicaid" can be challenging, especially when it comes to understanding the "Look-Back Period" and the "Penalty Period". These two concepts are crucial for anyone considering applying for Medicaid benefits, particularly for long-term care services. Knowing how they work can help individuals and families plan their finances effectively and avoid costly mistakes.

The "Medicaid Look-Back Period" refers to a specific timeframe during which Medicaid reviews an applicant's financial transactions to determine eligibility for benefits. Typically, this period spans "five years" prior to the application date. During this time, Medicaid investigates any asset transfers, gifts, or sales that may have been made for less than fair market value. The purpose of this assessment is to prevent individuals from deliberately depleting their assets to qualify for Medicaid.

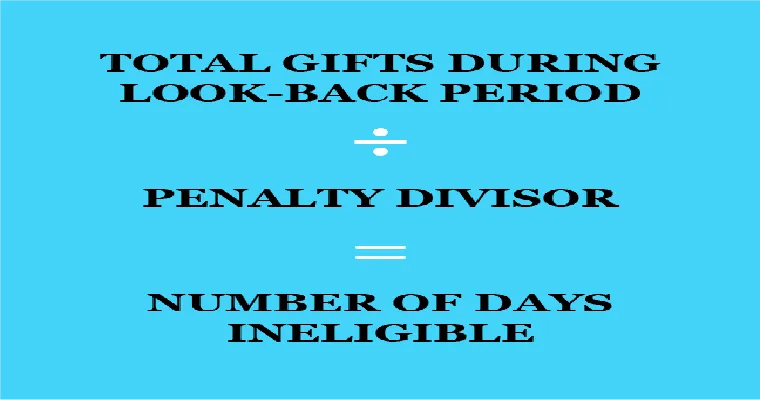

If Medicaid identifies any disqualifying transactions within the Look-Back Period, it can impose a "Penalty Period". This is a duration during which the applicant is ineligible for Medicaid benefits based on the value of the assets transferred. The length of the Penalty Period is calculated by dividing the total value of the transferred assets by the average monthly cost of nursing home care in the state. For instance, if someone transferred $30,000 worth of assets and the average monthly cost of care is $6,000, the resulting Penalty Period would be five months.

Understanding the implications of the Look-Back and Penalty Periods is vital for effective financial planning. For those considering long-term care, it is advisable to consult with a legal or financial advisor who specializes in Medicaid planning. This expert guidance can help individuals structure their finances in a way that minimizes penalties and maximizes eligibility for Medicaid benefits.

It is also important to note that not all asset transfers are treated the same. Certain transfers, such as those made to a spouse, disabled child, or for the purpose of paying for medical care, may be exempt from penalties. Therefore, understanding which transactions are permissible can significantly impact one's eligibility.

In summary, the "Medicaid Look-Back Period" and the "Penalty Period" are critical components of Medicaid eligibility that require careful consideration. By being proactive and informed, individuals can navigate these regulations effectively, ensuring that they receive the care they need without unnecessary financial strain. Always seek professional guidance to ensure compliance with Medicaid rules and to protect your financial well-being.