Understanding "asset limits for Medicaid eligibility" is crucial for individuals and families seeking financial assistance for healthcare services. Medicaid, a government program designed to provide healthcare coverage for low-income individuals, has specific "asset limits" that determine who qualifies for its benefits. These limits vary by state and can significantly impact the ability to receive necessary medical care. In this article, we will explore the details of asset limits, how they affect Medicaid eligibility, and strategies to navigate these regulations.

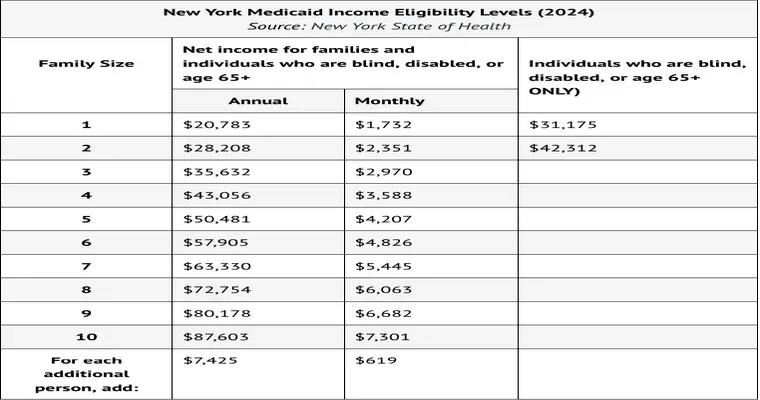

Medicaid eligibility is typically based on two primary factors: "income" and "assets". While income limits are often straightforward, asset limits can be more complex due to the various exemptions and allowances in place. Generally, for an individual applying for Medicaid, the asset limit is set at a specific amount, which may vary by state. For couples, the asset limit is usually higher, allowing both partners to qualify for assistance.

It is important to note that not all assets count towards the Medicaid asset limit. For example, primary residences, personal belongings, and certain types of vehicles may be exempt from consideration. In many states, individuals may also be allowed to have a limited amount of cash savings and other resources without exceeding the asset limit. This means that understanding what constitutes countable assets is essential for anyone seeking Medicaid coverage.

States have the flexibility to establish their own asset limits, which can create disparities in eligibility across the country. As of recent guidelines, most states set the asset limit for an individual at around $2,000, while couples may have a limit closer to $3,000 or more, depending on state regulations. These figures can change, so it is vital for applicants to check the specific rules in their state.

Planning ahead is key for individuals who want to ensure they meet the "Medicaid asset limits". Many people explore options such as "spending down" their assets to qualify for Medicaid. This process involves using excess resources to pay for medical expenses or other necessary costs, ensuring that the individual’s countable assets fall below the designated limits.

Another strategy is to utilize "Medicaid trusts", which can help individuals protect their assets while still qualifying for Medicaid benefits. These trusts can be complicated, so it is advisable to seek guidance from a financial advisor or attorney who specializes in elder law or Medicaid planning.

In conclusion, being informed about "asset limits for Medicaid eligibility" is essential for anyone considering applying for this vital healthcare program. By understanding the rules and planning accordingly, individuals can navigate the complexities of Medicaid eligibility more effectively. Whether through spending down assets or utilizing trusts, there are strategies available to help meet eligibility requirements and access necessary medical care.