When a "Medicaid" recipient passes away, many families wonder about the implications for their estate, particularly regarding "Medicaid recovery". Medicaid has specific rules that allow it to seek reimbursement for the costs of care provided to beneficiaries, which can complicate the distribution of assets after death. In this article, we will explore whether "Medicaid can recover money bequeathed" to an estate and provide guidance on what families should consider during this process.

Understanding Medicaid Recovery

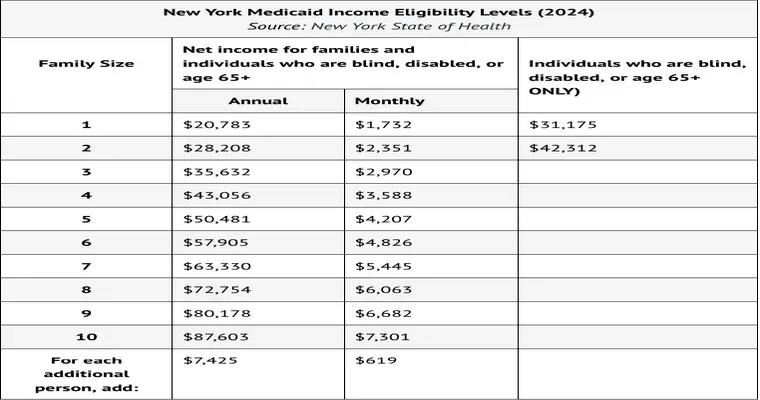

Medicaid is a state and federal program designed to provide healthcare coverage for low-income individuals, including the elderly. When a person receives Medicaid benefits, the state may seek to recover the costs of those benefits from the recipient's estate after their death. This process is known as "Medicaid estate recovery". However, the rules governing this recovery can vary by state, and understanding these nuances is crucial for families navigating the aftermath of a loved one's passing.

The Role of the Estate

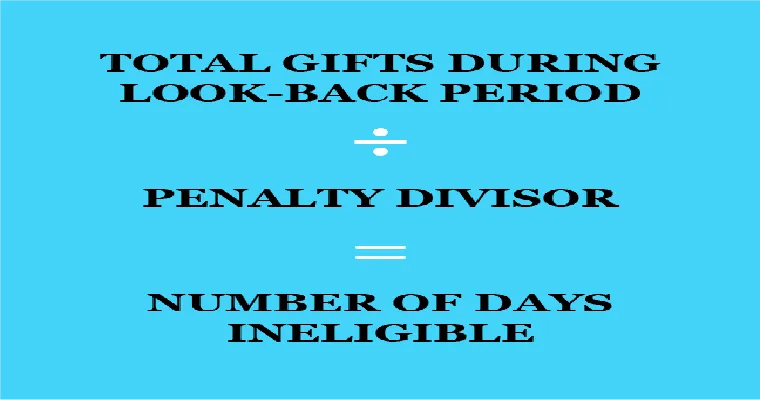

When a "Medicaid recipient" dies, their estate typically includes all assets they owned at the time of death, such as real estate, bank accounts, and personal property. If the estate is subject to recovery, Medicaid may file a claim against it to recoup funds spent on the recipient's care. This means that any money or property bequeathed to heirs could potentially be diminished by the state's claim.

Exceptions to Medicaid Recovery

While Medicaid has the right to recover funds, there are important exceptions that families should be aware of. For instance, many states exempt the estate of a surviving spouse from recovery. Additionally, if the deceased individual has surviving children with disabilities or who are under the age of 21, the estate may also be protected from Medicaid claims.

The Importance of Estate Planning

To mitigate the impact of Medicaid recovery, effective "estate planning" is essential. Families should consider strategies such as setting up a trust or transferring assets before the recipient applies for Medicaid. Consulting with an attorney who specializes in elder law can provide invaluable assistance in navigating these complex issues and ensuring that loved ones are protected.

Conclusion

In summary, Medicaid can indeed recover money bequeathed to an estate after a recipient dies, but there are exceptions and strategies that families can utilize to minimize this impact. Understanding the rules of your state and engaging in proactive estate planning can help protect your family's legacy. If you have concerns about "Medicaid recovery", it is advisable to seek legal counsel to explore your options and ensure that your loved one's wishes are honored.