When a "veteran" sells their home, it is crucial to ensure that the "proceeds" from the sale do not jeopardize their "VA pension" benefits. Understanding how to navigate this process can help veterans maintain their financial security while making the most of their home sale. In this article, we will explore effective strategies for protecting the proceeds from a veteran's home sale to safeguard their VA pension.

One of the primary concerns for veterans is that the proceeds from the sale of their home may count as income, potentially affecting their eligibility for pension benefits. To prevent this, veterans should consider several approaches:

First, it is essential to consult with a "financial advisor" or a "VA benefits specialist". These professionals can provide invaluable guidance tailored to individual circumstances, ensuring that veterans understand how the sale proceeds may impact their pension. They can also help veterans explore ways to structure their finances to protect their benefits.

Another effective strategy is to reinvest the proceeds from the home sale into exempt assets. The VA allows veterans to preserve their benefits if they use the funds to purchase a new home, invest in a "qualified annuity", or put the money into a "special needs trust". These options can help veterans maintain their financial stability while ensuring they remain eligible for their VA pension.

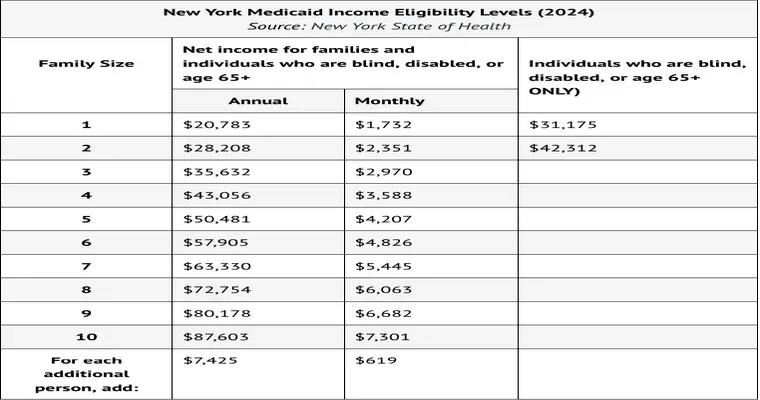

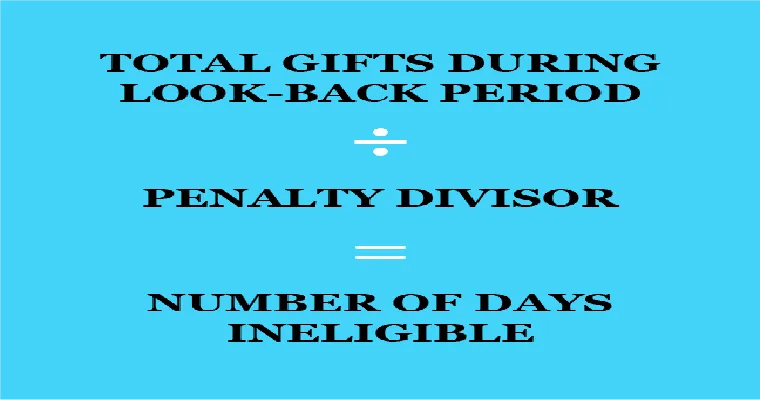

Additionally, veterans should be aware of the "Asset and Income Limits" set by the VA. By strategically managing their assets, they can potentially avoid exceeding these limits. This may involve spending down excess funds on necessary expenses, such as medical care or home modifications, which can be beneficial in maintaining eligibility for their pension.

Veterans should also keep accurate records of all transactions related to their home sale. This includes details of the sale, any expenses incurred, and how the proceeds are managed. Having a clear paper trail can be vital if the VA requests documentation to verify the veteran's financial situation.

Lastly, staying informed about changes to VA regulations is crucial. The rules governing VA pensions and benefits can evolve, and being proactive about understanding these changes can help veterans make informed decisions about their finances.

In conclusion, protecting the proceeds of a veteran's home sale is essential to ensure that they do not lose their VA pension. By consulting with professionals, reinvesting funds wisely, managing assets carefully, maintaining thorough records, and staying informed about VA regulations, veterans can safeguard their benefits and secure their financial future.