When seeking "Medicaid eligibility", many individuals may encounter challenges due to income limits. One effective strategy to overcome these obstacles is to set up a "Miller Trust", also known as a Qualified Income Trust. This financial tool allows individuals to qualify for Medicaid while managing excess income. In this article, we will explore the steps involved in establishing a Miller Trust and the benefits it provides for those seeking Medicaid assistance.

Understanding the Miller Trust

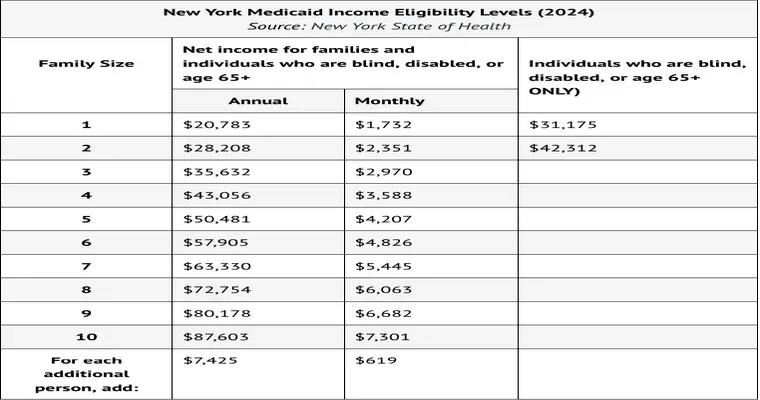

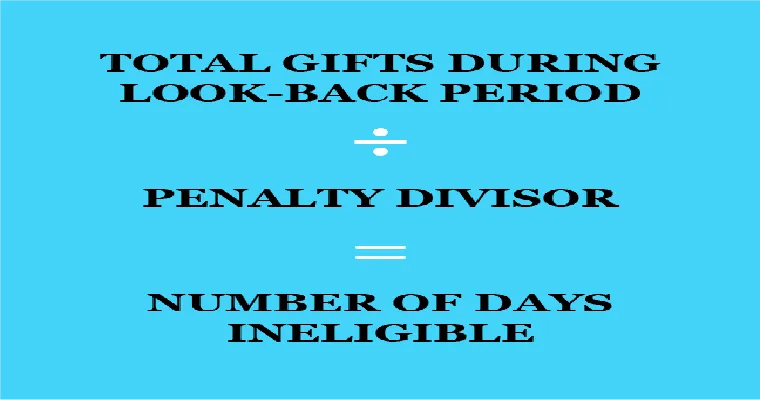

A Miller Trust is specifically designed for individuals whose income exceeds the Medicaid eligibility limits. By placing excess income into this trust, applicants can reduce their countable income, making them eligible for Medicaid benefits. It is essential to understand that a Miller Trust must adhere to specific guidelines set by state Medicaid programs.

Steps to Set Up a Miller Trust

1. "Consult an Attorney": The first step in creating a Miller Trust is to consult with an attorney who specializes in elder law or Medicaid planning. They can help navigate the complexities of the trust and ensure compliance with state regulations.

2. "Draft the Trust Document": The attorney will assist in drafting a trust document that meets the requirements of the state. This document will outline the trust's purpose, the trustee's responsibilities, and the beneficiaries.

3. "Choose a Trustee": A trustee is responsible for managing the trust. This can be an individual or an institution, such as a bank. It is crucial to select someone trustworthy and knowledgeable about managing funds.

4. "Open a Bank Account": Once the trust document is in place, you must open a separate bank account in the name of the Miller Trust. This account will hold all income that exceeds the Medicaid limits.

5. "Deposit Excess Income": Any income above the Medicaid threshold must be deposited into the Miller Trust account. This may include Social Security benefits, pensions, or other sources of income.

6. "Disburse Funds Appropriately": The funds in the Miller Trust can be used for specific expenses, such as medical care or personal needs. It is vital to keep accurate records of all expenditures to demonstrate compliance with Medicaid requirements.

7. "Apply for Medicaid": After establishing the Miller Trust, you can proceed with your Medicaid application. The trust will help ensure that your countable income is within the allowable limits.

Benefits of a Miller Trust

Establishing a Miller Trust offers several advantages for those seeking Medicaid eligibility. Firstly, it allows individuals to retain control over their income while still qualifying for benefits. Additionally, it provides a legal mechanism to protect assets that might otherwise be counted against Medicaid eligibility.

Moreover, a Miller Trust can help cover essential medical expenses that Medicaid may not fully pay, ensuring that individuals receive the care they need without facing financial strain.

Conclusion

Setting up a Miller Trust can be a crucial step for individuals seeking "Medicaid eligibility" who find themselves above the income limits. By following the appropriate steps and working with a qualified attorney, you can navigate the complexities of Medicaid planning effectively. Remember, the goal is to preserve your income while ensuring access to essential medical care. Taking action now can lead to peace of mind for you and your loved ones in the future.