Managing "Medicaid eligibility" while ensuring your loved one receives the care they need can be challenging, especially when it comes to handling profits from a property, such as a "condo". As you navigate this process, it is crucial to find creative and compliant ways to spend down these profits. Here are some practical ideas that can help you utilize these funds effectively while maintaining your mother’s "Medicaid eligibility".

1. Prepay Medical Expenses

One of the most straightforward ways to spend down profits is by prepaying medical expenses. This can include paying for upcoming medical bills, purchasing medical supplies, or covering other healthcare-related costs. By doing this, you not only ensure that your mother has the necessary services but also help to reduce her assets, keeping her within the "Medicaid eligibility" limits.

2. Home Modifications

If your mother’s living situation can be improved with some modifications, consider using the funds to make her home more accessible. This can include adding grab bars, installing a walk-in shower, or widening doorways for wheelchair access. These enhancements can significantly improve her quality of life and may also be covered under future "Medicaid" services, demonstrating a wise use of the condo profits.

3. Purchase a Prepaid Funeral Plan

Investing in a "prepaid funeral plan" can be a compassionate way to manage funds while ensuring that future funeral costs are covered. This approach not only helps in spending down assets but also alleviates the financial burden on family members during a difficult time. Just ensure that the plan is compliant with "Medicaid" regulations.

4. Pay Off Debts

If your mother has any outstanding debts, consider using the profits to pay them off. This can include credit card debt, personal loans, or even medical bills. Reducing her liabilities can improve her financial situation while simultaneously lowering her asset count, helping maintain her "Medicaid eligibility".

5. Contribute to a Special Needs Trust

If your mother has special needs or requires ongoing care, you might consider setting up a "special needs trust". This type of trust allows you to manage her assets while still ensuring that she qualifies for government benefits. It’s essential to consult with a legal expert to ensure that the trust is set up correctly and complies with "Medicaid" regulations.

6. Invest in Personal Care Services

Using funds for personal care services can be a beneficial way to spend down profits. This could include hiring professional caregivers for in-home assistance or enrolling her in adult day care programs. Not only does this improve her quality of life, but it also qualifies as an allowable expense under "Medicaid" guidelines.

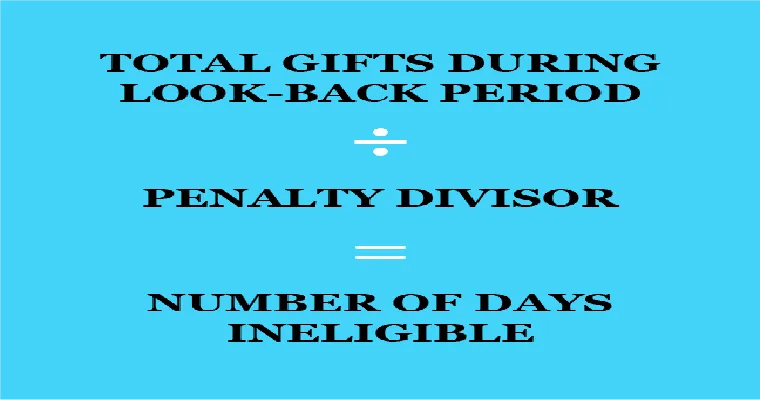

7. Gift Money to Family Members

While gifting money to family members is another option, it's essential to be cautious. "Medicaid" has specific rules about asset transfers, and substantial gifts could affect eligibility. However, smaller gifts made over a period of time may be acceptable. Always consult with a financial advisor or "Medicaid" expert before proceeding with this option.

8. Purchase Household Items

Investing in household necessities can also be a practical way to spend down funds. This might include buying appliances, furniture, or other essential items that will improve your mother’s living environment. Ensure that these purchases are reasonable and necessary to avoid scrutiny by "Medicaid".

Conclusion

Finding viable ways to spend down your mother’s condo profits while maintaining her "Medicaid eligibility" can be a daunting task. However, with careful planning and consideration of the options outlined above, you can ensure that her needs are met without jeopardizing her benefits. Always remember to seek professional guidance to navigate the complexities of "Medicaid" regulations effectively. By making informed decisions, you can provide your mother with the care she deserves while managing her financial situation responsibly.