When faced with the emotional and financial burden of caring for a loved one with dementia or other memory-related conditions, many families find themselves asking, ""I cannot afford to keep my dad in memory care."" This concern often arises when self-paying for care becomes unsustainable and "Medicaid eligibility" seems out of reach. Fortunately, there are several options available to help alleviate the financial strain while ensuring your dad receives the care he needs.

Explore Alternative Funding Sources

One of the first steps you can take is to explore alternative funding sources. Many families overlook the possibility of "long-term care insurance", which may cover some of the costs associated with memory care. If your dad has a policy, now is the time to review it and understand what benefits are available.

Additionally, consider whether your dad may be eligible for any "veterans benefits" if he has served in the military. Programs like the Aid and Attendance benefit can provide financial assistance for eligible veterans and their spouses, potentially covering some of the costs associated with memory care.

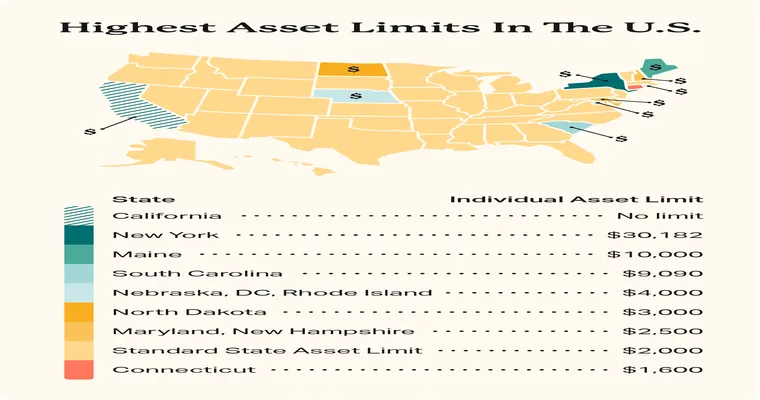

Research State Assistance Programs

While federal Medicaid may seem out of reach, many states offer their own assistance programs that can help families in similar situations. These programs often have different eligibility criteria compared to Medicaid, so it's essential to research what options are available in your state. Some states also provide funding for "home and community-based services", which can help reduce the financial burden while allowing your dad to receive care at home.

Consider Sliding Scale Facilities

Another option is to look into "sliding scale memory care facilities". These facilities adjust their fees based on a resident's income and financial situation. While they may have limited availability, sliding scale facilities can provide high-quality care at a more affordable rate.

Explore Payment Plans and Financial Assistance

Many memory care facilities offer payment plans or financial assistance programs to help families manage costs. If you are currently self-paying, reach out to your dad’s facility to discuss possible options. Some facilities may provide discounts for upfront payments or work with families to create a manageable payment plan.

Look into Non-profit Organizations

There are numerous non-profit organizations that provide resources and support for families dealing with memory care challenges. Some may offer financial assistance or grants specifically aimed at helping families afford care for loved ones with dementia. Research local and national non-profits that focus on memory care, as they may have programs that can help ease your financial burden.

Consider Respite Care Services

If the financial burden is becoming overwhelming, you might want to consider "respite care services". These services provide temporary care for your dad, allowing you to take a break while still ensuring he receives the necessary support. This can be a more affordable option, especially if you only need assistance for a short period.

Plan for Medicaid Reassessment

If your dad's financial situation changes or if you believe he may qualify for Medicaid in the future, it is essential to plan for a "Medicaid reassessment". Medicaid has specific eligibility requirements that can vary by state and situation. Consulting with a Medicaid planner or elder law attorney can help you navigate the process and ensure that you are taking the right steps.

Seek Professional Guidance

Lastly, consider seeking professional guidance from a financial advisor who specializes in elder care. They can help you evaluate your financial situation and identify strategies to manage costs effectively. Additionally, they can assist you in understanding the complicated landscape of government benefits and funding options available for memory care.

Conclusion

Navigating the financial complexities of memory care can be overwhelming, especially when you find yourself saying, ""I cannot afford to keep my dad in memory care."" However, by exploring various funding sources, researching alternative state programs, and seeking professional guidance, you can find solutions that work for your family's unique situation. Remember, you are not alone in this journey, and there are resources available to help you ensure your dad receives the care he deserves.