Navigating the complexities of "Medicaid" eligibility can be a daunting task, especially when it comes to understanding the implications of "asset protection" for aging parents. Many families grapple with the question of whether to conceal their parents' "assets" to qualify for Medicaid, despite the clear intent of these resources being designated for their care. When it comes to ensuring proper care for elderly loved ones, transparency and ethical considerations should be at the forefront of any decision-making process.

When an individual requires long-term care, the financial resources available can significantly influence their eligibility for Medicaid assistance. In many cases, families find themselves in a dilemma: should they attempt to hide or transfer assets to help qualify for Medicaid, or should they utilize those assets to provide the best possible care for their parents? This question is not just about finances; it also touches on the moral responsibilities we have toward our aging loved ones.

One of the reasons families may consider hiding assets is the overwhelming cost of long-term care. The average stay in a nursing home can run into thousands of dollars per month, and many families are unprepared for this financial burden. As a result, some may think that concealing assets will prevent them from being depleted too quickly, allowing families to offer a higher standard of care for longer. However, this approach can lead to significant legal complications and potential penalties if discovered by Medicaid.

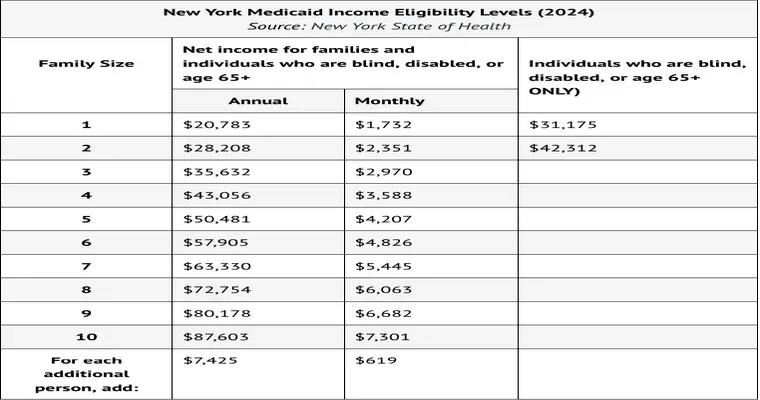

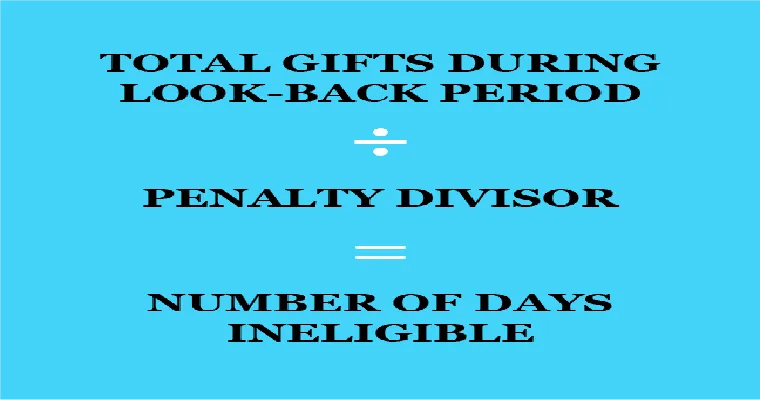

Moreover, it is essential to understand that Medicaid has strict rules regarding asset limits. While the threshold varies by state, most programs require applicants to have limited assets to qualify. This can create a sense of urgency to hide or transfer assets, but doing so without proper planning can backfire. Families may face a period of ineligibility for Medicaid benefits if improper asset transfers come to light.

Instead of resorting to hiding assets, families should consider legitimate avenues for planning and care. Consulting with a "Medicaid planning" expert can provide insights into legal options for asset protection that comply with Medicaid regulations. Strategies such as setting up a "trust", utilizing specific exemptions, or spending down assets on care-related expenses can help families navigate the system without jeopardizing their loved ones' access to necessary care.

In addition, open communication among family members about the financial situation and care needs can foster a more supportive environment. This transparency can lead to better decisions that prioritize the well-being of parents rather than focusing solely on financial gain. Families should remember that the primary goal should be securing the best possible care for their loved ones, and that often requires using available resources wisely.

Ultimately, the question of why people hide assets when their parents have them revolves around the need for proper care versus fear of financial depletion. While Medicaid can be difficult to navigate, ethical considerations and transparent planning are crucial for ensuring that aging parents receive the support they need. By focusing on strategic planning rather than asset concealment, families can provide their loved ones with the care they deserve while remaining compliant with Medicaid requirements.