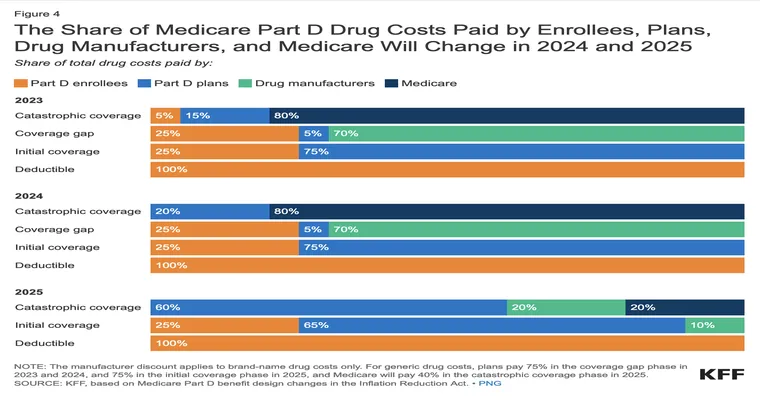

If you are facing the unfortunate situation where "Medicare Part D" has terminated your Mom's coverage, you may be feeling confused and concerned. Understanding the reasons behind this termination and whether it is permissible is crucial for navigating your options. Medicare Part D provides essential "prescription drug coverage" for millions of Americans, and losing this coverage can have significant implications on your loved one's health and finances.

Medicare Part D can terminate coverage for several reasons. One common reason is failure to pay premiums. If your Mom's premiums were not paid on time, the plan could have ended her coverage. Another reason could be if she no longer resides in the service area of the plan. It's important to verify her current address and ensure it falls within the plan's coverage area.

Additionally, if your Mom is enrolled in a "Medicare Advantage Plan", her Part D coverage could be affected if she switched or disenrolled from that plan. Changes in eligibility can also lead to termination. For example, if your Mom becomes eligible for "Medicaid" or another type of assistance, this may impact her Part D coverage.

If you believe the termination was unjust, you have the right to appeal the decision. The first step is to contact the "Medicare plan provider" to understand the specific reason for the termination. They should provide you with a written notice detailing why coverage was ended. This notice is essential for any appeal process.

Once you have the information, you can file an appeal through the Medicare system. This process typically involves completing a form and submitting any relevant documentation that supports your case. You also have the option to escalate the issue to the "Medicare Ombudsman" if you are not satisfied with the response from the plan provider.

It is vital to act quickly, as there are strict deadlines for appeals. Ensuring that your Mom has continuous access to her medications is of utmost importance, so exploring alternative plans during this time may also be beneficial. You can use the "Medicare Plan Finder" tool to research other Part D options available in your area.

In conclusion, while it can be distressing to learn that "Medicare Part D" has terminated your Mom's coverage, it is essential to understand the reasons and your options. By staying informed and proactive, you can help ensure that your loved one retains access to the necessary prescription medications and healthcare services. If you have further questions or require assistance, consider reaching out to a local "Medicare counselor" or a legal expert specializing in elder law for personalized guidance.