As seniors enter their "80s", many face the daunting reality of being "penalized" for not having "prescription drug coverage". This situation can lead to increased costs and limited access to necessary medications. Understanding the reasons behind these penalties and exploring ways to combat them is crucial for seniors and their families.

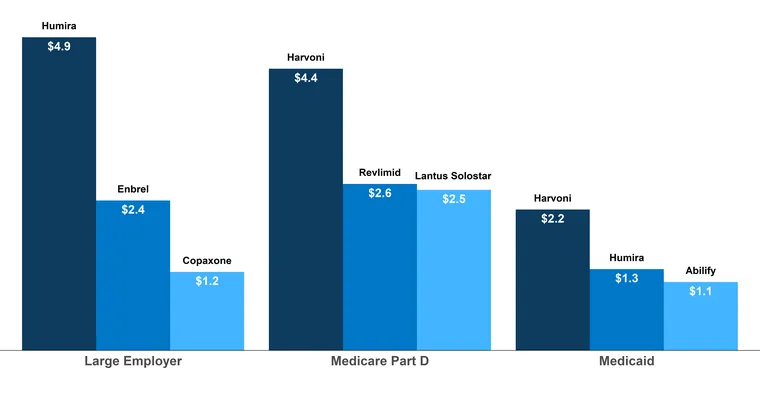

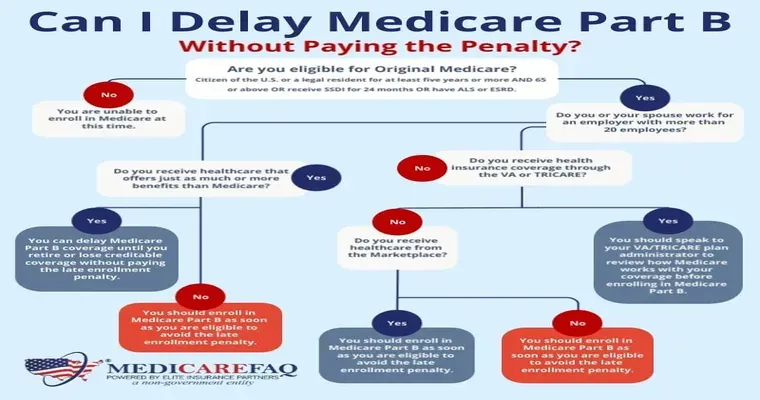

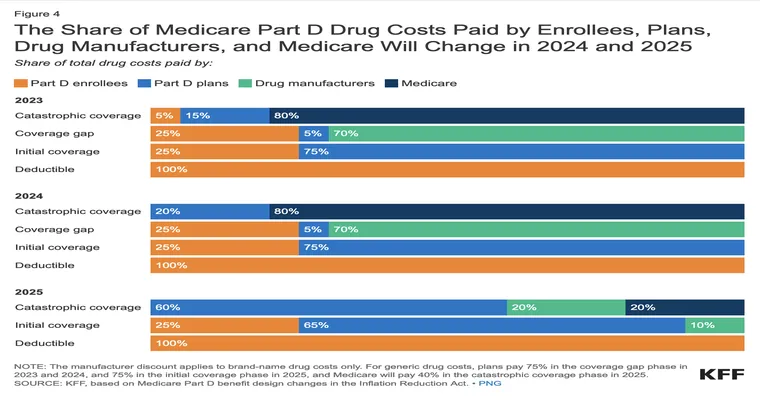

The penalties for not having prescription drug coverage are primarily tied to the "Medicare Part D" program. Designed to help seniors afford medications, Medicare Part D imposes a late enrollment penalty for those who do not sign up when they are first eligible. This penalty can result in higher premiums for the rest of their lives, which can be particularly burdensome for seniors in their 80s who are often on fixed incomes.

One reason this penalty exists is to encourage timely enrollment in the program. The government aims to ensure that seniors start receiving the necessary coverage as soon as they become eligible, which typically occurs at age 65. However, many seniors may not realize the importance of enrolling in Part D or may face barriers that prevent them from doing so. These barriers can include confusion about the enrollment process, financial constraints, or simply the belief that they do not need prescription coverage.

Moreover, the late enrollment penalty is calculated based on the number of months a senior was eligible but did not enroll, which can significantly increase costs over time. For seniors in their 80s, who may already be dealing with multiple health issues and prescriptions, this added financial burden can be overwhelming.

Fortunately, there are ways to fight against this penalty. First, it is essential for seniors to be informed about their options. Educational resources are available through organizations like the "National Council on Aging" and local Area Agencies on Aging, which can help seniors navigate the complexities of Medicare and understand the importance of timely enrollment.

Second, seniors should consider seeking help from licensed insurance agents or Medicare counselors. These professionals can provide personalized guidance and help seniors find plans that suit their needs and budget, potentially avoiding penalties altogether.

Lastly, advocacy is crucial in addressing this issue. Seniors and their families can contact their representatives to express concerns about the penalties associated with prescription coverage. By raising awareness and urging policymakers to consider reforming the system, we can work towards a more equitable solution that does not penalize seniors for circumstances beyond their control.

In conclusion, the penalties faced by seniors in their 80s for not having prescription coverage can have serious implications for their health and finances. By understanding the reasons behind these penalties and taking proactive steps to seek guidance and advocate for change, we can help ensure that seniors receive the support they need without the burden of unnecessary financial penalties.