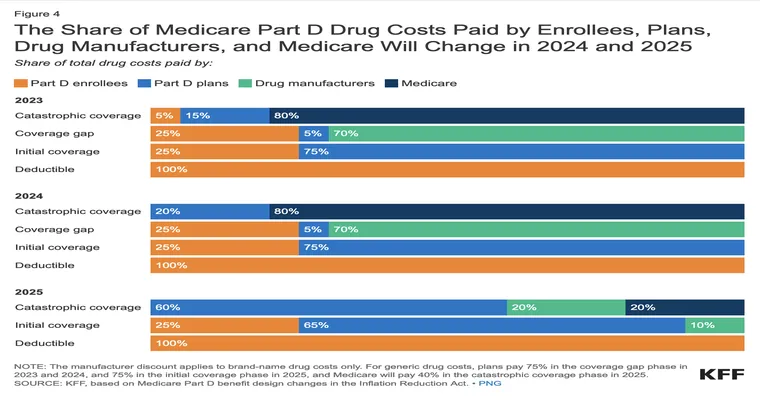

As we enter 2023, many Medicare beneficiaries are confronted with the shocking news of a "300% increase" in their current "Part D plans" for "prescription coverage". This staggering rise in costs has left many individuals searching for "reasonably priced options" to manage their healthcare expenses effectively. Understanding the intricacies of these plans is crucial for making informed decisions that can significantly impact your financial well-being.

The "Part D program" was established to help Medicare beneficiaries afford their prescription medications. However, the recent surge in costs has raised concerns about the sustainability of these plans for many individuals. As a result, it is essential to explore alternatives that provide adequate coverage without breaking the bank.

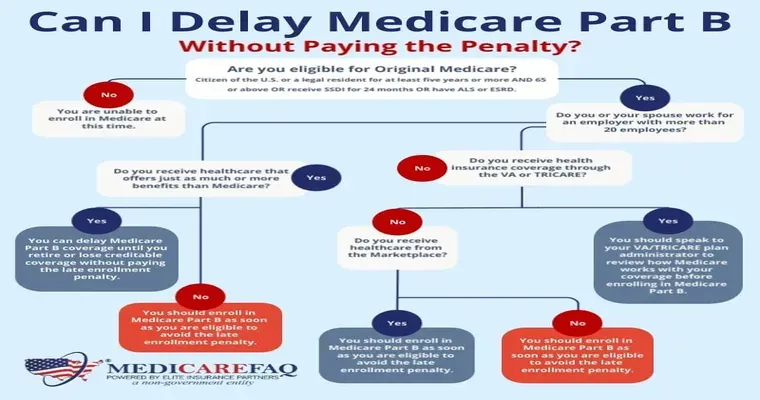

One of the most effective strategies is to compare different "Part D plans" based on your specific medication needs. Each plan varies in terms of premiums, deductibles, and out-of-pocket costs, which means that what works for one person may not be suitable for another. Online comparison tools can help you assess your options, ensuring that you choose a plan that offers the best value for your circumstances.

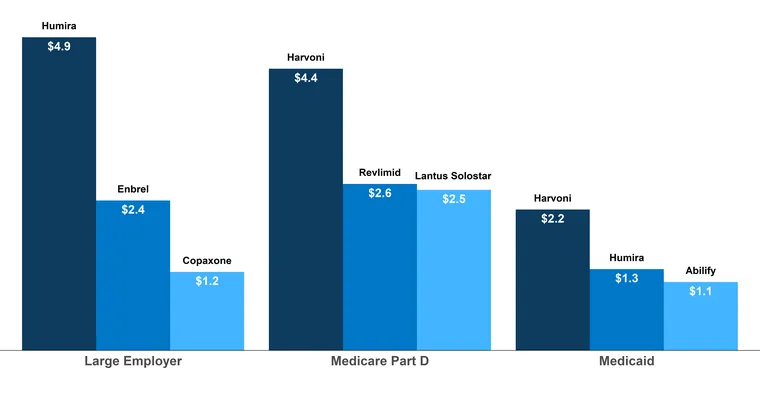

Additionally, consider enrolling in a plan with a lower premium that still covers your essential medications. Some plans may have higher deductibles but can be more economical in the long run if your medication costs are manageable. Be sure to check the "formulary" of each plan to confirm that your prescriptions are included at an affordable tier.

Moreover, don’t overlook the importance of "generic medications". Whenever possible, opt for generic versions of your prescribed drugs, as they are often significantly cheaper than their brand-name counterparts. Many "Part D plans" cover generics at a lower cost, which can help you save money while still receiving the treatment you need.

In light of the dramatic 300% hike in costs, it’s also wise to reach out to a licensed insurance agent who specializes in Medicare. They can provide personalized advice and help you navigate the complexities of the various plans available. Their expertise can be invaluable in identifying plans that align with your healthcare needs and budget.

In conclusion, the impending 300% increase in "Part D plans" for prescriptions is a wake-up call for Medicare beneficiaries. By taking proactive measures to compare plans, considering generics, and seeking professional guidance, you can find "reasonably priced options" that meet your needs. Stay informed and make empowered choices to ensure that your prescription coverage remains manageable and effective in the coming year.